US equities started the new week on a solid footing, following a strong rally during regular trading that sent major benchmarks to new highs, with stock futures barely changing on Monday night. Following Monday’s robust gains, futures linked to the Dow Jones Industrial Average, the S&P 500, and the Nasdaq 100 also declined slightly, indicating Read More…

Tag: stock market

Nasdaq 100 Futures (NQ) – Technical Analysis 6 January 2026

Introduction The long-term NQ trend continues to the upside along with the other US index markets. The price has been consolidating, however, since hitting an ATH of 26,399 in November, and a symmetrical triangle is now forming. Traders and investors are watching U.S. inflation data, labor market reports, and the FOMC, and any bullish developments Read More…

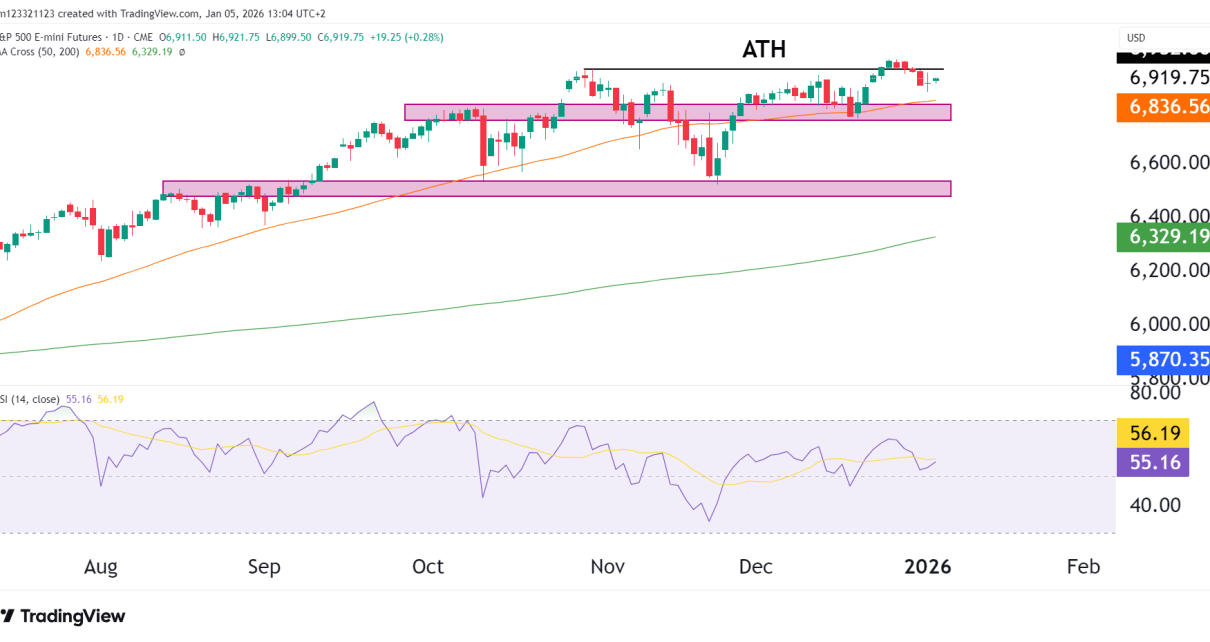

S&P 500 (ES) – Technical Analysis 5 January 2025

Introduction ES continues to consolidate just below all-time highs, with bulls pushing the price up after each pullback. The 50 moving average is still holding as support, and as long as bulls maintain that, the momentum is firmly on the upside. The market is closely watching U.S. inflation data, labor market reports, and FOMC but Read More…

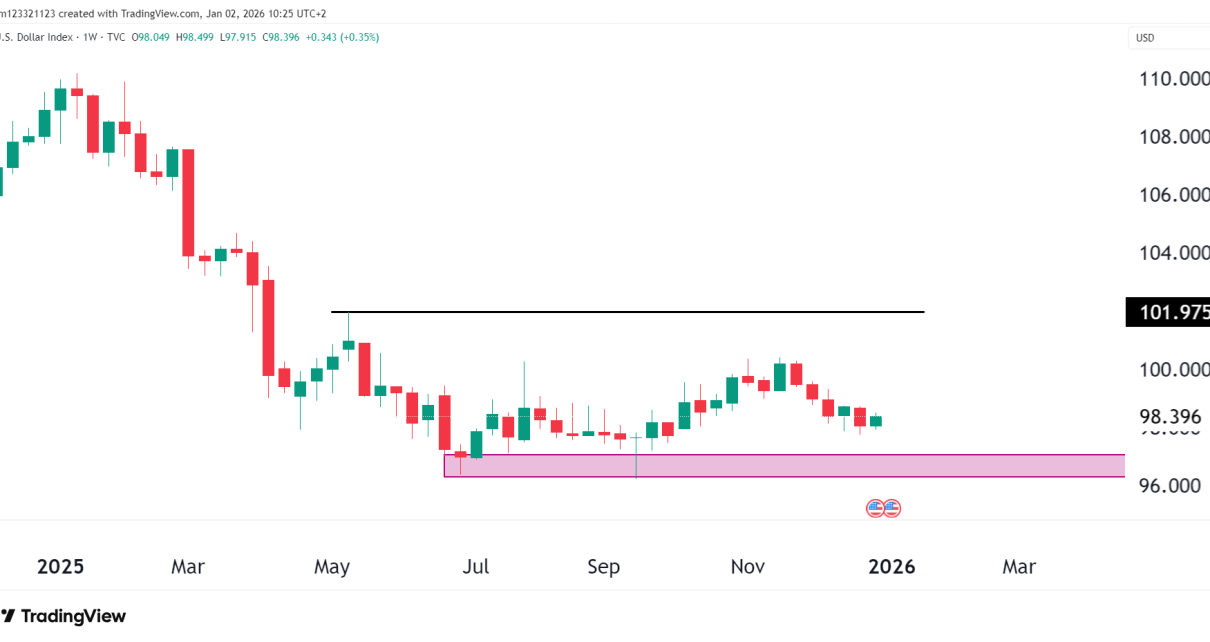

U.S. Dollar Index (DXY), Technical Analysis 2 January 2026

Introduction The Dollar index (DXY) dropped 9.3% in 2025, mainly due to the U.S interest rate advantage fading as global growth and risk appetite improved. This meant money flowed elsewhere. It has also been a factor that has helped US indices to rally, with the S&P 500 rallying 16.8% for the year. Let’s take a Read More…

Three Years Up: Can US Equities Survive a More Volatile 2026?

US equities maintain firm momentum heading into 2026, despite persistent macroeconomic uncertainty and extreme policy volatility. Wall staged an impressive recovery after a deeper correction triggered during the spring amid Trump’s tariff announcement. AI enthusiasm, resilient corporate earnings, and easing trade fears contributed to the rally. The S&P 500 closed 2025 with nearly 16% gains, Read More…

Raymond Loves OneUp Trader After Withdrawing $17,200

Introduction Raymond, a 53-year-old momentum day trader from Bowie, United States, earned his funded account on April 21, 2025, after completing his evaluation in just 10 days. A loyal member of the OneUp Trader community since 2019 trades the $50,000 account, and his results show the payoff of a simple process, patience, and strict risk Read More…