Introduction Gold Futures (GC) have moved sharply higher, extending their rally well beyond the $5,000 level and accelerating deeper into price discovery. After spending much of the past year grinding higher in a steady uptrend, gold has shifted into a more aggressive phase, with buyers pushing prices higher with even more strength. This move represents Read More…

Tag: stock market

Crude Oil (CL) Technical Analysis, 28 January 2026

Introduction Light Crude Oil Futures (CL) have moved sharply higher from long-term support, climbing back above the $62 level. This move breaks price out of the lower trading range that had held crude oil prices in place for several months. After repeatedly finding buyers in the mid-$50s, WTI crude oil futures are now showing early Read More…

S&P 500 (ES) Technical Analysis, 27 January 2026

Introduction The S&P 500 E-mini Futures (ES) are once again near the top of their recent range, trading just below the 7,000 level after holding earlier support. Price bounced cleanly from the latest pullback and is now testing resistance again, which shows that buyers are still in control even after multiple attempts to push lower. Read More…

Gold (GC) Technical Analysis, 26 January 2026

Introduction Gold Futures (GC) have extended their breakout, pushing decisively above the $5,000 level and further into price discovery. What began as a clean move above prior all-time highs has now turned into a powerful bullish trend, with buyers showing little hesitation even as momentum surges. Gold has been a top performer in the past Read More…

S&P 500 (ES) Technical Analysis, 23 January 2026

Introduction The S&P 500 E-mini Futures (ES) continue to trade just below the 7,000 handle, consolidating after an extended rally that has been persisting since April. Price remains near all-time highs, but recent action shows an intensifying battle between bulls and bears as buyers become more selective about the prices they pay. Summary Primary trend: Read More…

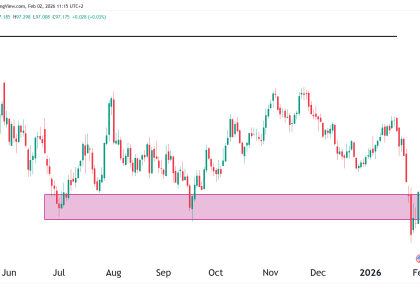

Crude Oil (CL) Technical Analysis, 22 January 2026

Introduction Crude Oil Futures (CL) are trading close to a clear long-term support area. After a long stretch of downside pressure, price is starting to steady. The overall trend is still corrective, but recent price action shows that selling has slowed. Buyers are beginning to step in and defend this level. Crude is now at Read More…