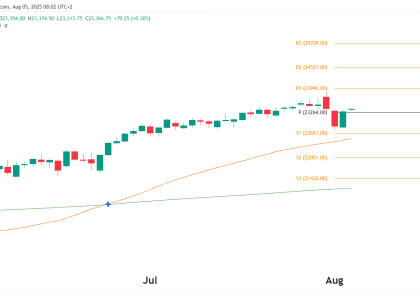

Technical Overview Resistance Zone & ATH Key Pivot Levels Pivot Zone Price ATH / R1 22,425.75 R2 23,151.50 R3 24,444.00 Pivot (neutral) 20,971.50 S1 (support) 20,084.00 It looks like its just a matter of time before the price breaks above the high but nothing is certain in markets so we have to wait and see. Read More…

Tag: NQ

NASDAQ 100 Futures (NQ) Technical Analysis, 30 May 2025

Technical analysis Zones Bull & Bear Cases Bull Case (higher probability) Bear Case (moderate risk) Trade Ideas Breakout Buy Opportunity (Momentum Continuation) Support Bounce Buy (Mean Reversion) Trades to Avoid Final Outlook Timeframe Outlook Bias Commentary Short-Term Consolidation Neutral-Bullish Price digestion after strong run-up Medium-Term Uptrend intact Bullish Higher lows, reclaim of MAs, poised for Read More…

NASDAQ Futures (NQ) Dead Cat Bounce?

Current Market Snapshot: Chart Technicals Double Bottom Formation Emerging Downtrend Break Under Scrutiny Moving Averages 🐂 Bullish Scenario If NQ can break and close above the descending trendline and 19,000, we have a confirmed breakout of the short-term downtrend channel. Targets on the upside: This setup would turn the recent price action from a bounce Read More…

NASDAQ (NQ) Plunges, Technicals Broken

The NASDAQ 100 futures (NQ) are suffering a brutal decline along with all other US markets, closing at 16,613, down 5.28% for the session. This marks a cumulative drop of 26.67% from the February highs, officially placing the tech-heavy index in bear market territory. Lets take a closer look. Macro & Fundamental Backdrop The NQ Read More…

Are Nasdaq Futures (NQ) Staging a Comeback?

Introduction The NASDAQ 100 (NQ) has staged a strong short-term recovery from the 19,000 support zone, pushing back above the lower trendline of the long-term rising channel. This move follows a steep correction off the double top formation near 22,000. Technical Breakdown Chart Structure Bull vs Bear Case Bull Case: Bear Case: Trade Opportunities (Short-Term) Read More…

NASDAQ 100 (NQ) Break Lower—Trend Shift or Bear Trap?

Introduction NASDAQ 100 E-mini futures (NQ) have broken below their long-term ascending trendline, signaling a potential shift in market momentum. The index failed to reclaim its all-time high (ATH) at 22,425.75, leading to a breakdown that has taken price below key support levels. As of today, NQ is trading at 20,676.25, up +0.34%, attempting to Read More…