Currency futures markets are recalibrating amid political and macroeconomic events in the US that are affecting investors’ sentiment toward the US dollar. The nomination of Kevin Warsh as the next Fed Chair has changed expectations toward a less flexible policy path. This has supported the US dollar across futures markets. The bias in euro FX Read More…

Tag: Future Trading Strategies

Nasdaq (NQ) Pull Back From Highs as Price Tests Support

Introduction Nasdaq 100 E-mini Futures (NQ) have pulled back from recent highs after failing to sustain a breakout attempt above all-time highs. Following a strong multi-month rally, price is now rotating lower toward support, marking a shift from momentum expansion into consolidation. From here, the first support will be the 50 moving average, which also Read More…

Markets vs. the Fed: What US Interest Futures Really Signaling for 2026?

US interest futures are currently at the center of the macro debate as markets and the Fed diverge on the timing and speed of policy easing. Pricing in 3-month SOFR futures on CME indicates that traders still expect a lower policy rate path over 2026 than today. However, the depth and pace of cuts implied Read More…

Gold Futures Surge Higher, Technical Analysis 29 Jan

Introduction Gold Futures (GC) have moved sharply higher, extending their rally well beyond the $5,000 level and accelerating deeper into price discovery. After spending much of the past year grinding higher in a steady uptrend, gold has shifted into a more aggressive phase, with buyers pushing prices higher with even more strength. This move represents Read More…

Crude Oil Futures Gains as Middle East Tensions Raise Supply Concerns

Crude oil futures are locked in a geopolitically driven rally, with Brent pushing toward the high $60s and WTI into the mid-$60s, marking three consecutive days of gains and roughly a 5% advance since January 26. The primary driver is escalating Middle East tension centered on Iran, a key OPEC producer pumping around 3.2 million barrels Read More…

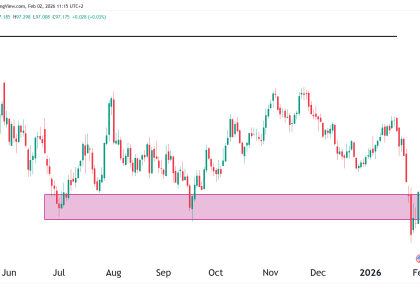

Crude Oil (CL) Technical Analysis, 28 January 2026

Introduction Light Crude Oil Futures (CL) have moved sharply higher from long-term support, climbing back above the $62 level. This move breaks price out of the lower trading range that had held crude oil prices in place for several months. After repeatedly finding buyers in the mid-$50s, WTI crude oil futures are now showing early Read More…