Introduction Dow Jones futures (YM) pulled back slightly, but have been rallying alongside the other US indices. The Dow is 1.3% away from the all-time high, and bulls will be trying to push above that in the next few sessions. Let’s take a look at the technicals and what they are telling us. Technical Overview Read More…

Tag: dow jones

Dow Jones Futures (YM): Technical Analysis, 22 September

Introduction The Dow Jones Futures (YM) have been grinding higher, recently printing 46,488 before cooling off slightly. While momentum has slowed, the index remains firmly in a bullish structure, supported by its moving averages and higher highs. Technical Update Trend Support:Price is holding comfortably above the 50-day MA at 45,131 and the 200-day MA at Read More…

Dow Jones Futures (YM) Technical Analysis 28 July 2025

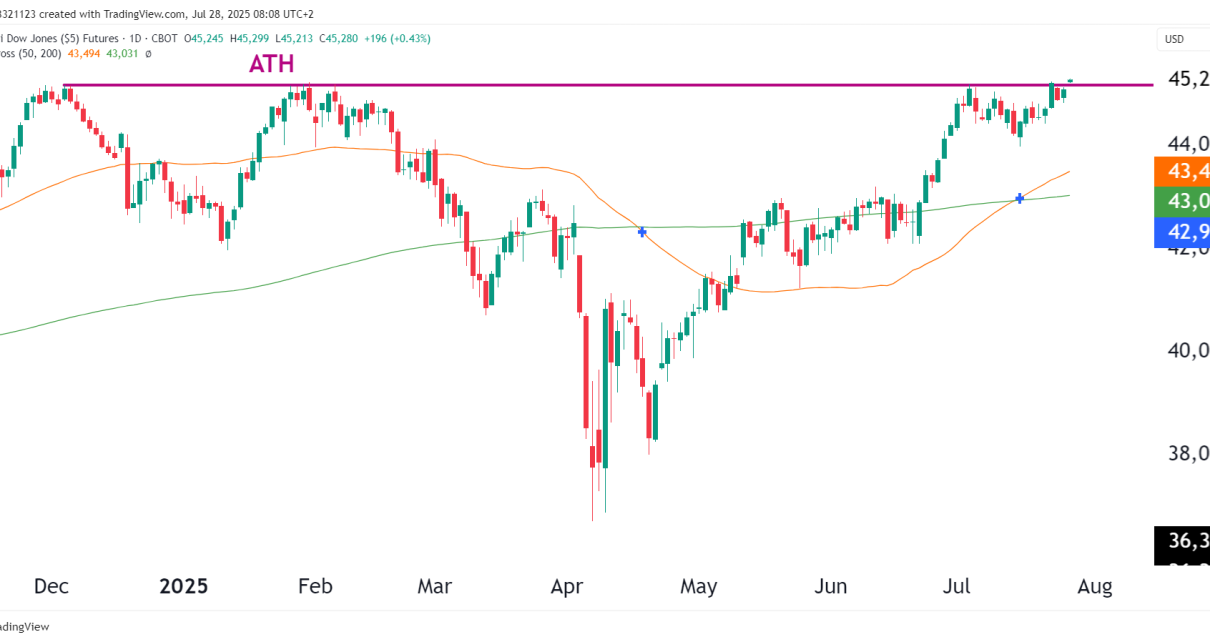

Current Price: 45,280Status: Testing new All-Time High (ATH) breakout levelChange (daily): +196 (+0.43%) Technical Analysis The Dow Jones Industrial Average (YM) has now caught up with the rest of the U.S. majors and is testing its ATH resistance near 45,280. Relative Strength vs Other U.S. Indices Index Status vs ATH Current Stance NQ (NASDAQ 100) Read More…

Dow Jones Futures (YM) Technical Analysis – July 9, 2025

Introduction The Dow Jones E-mini futures (YM) just hit an all-time high (ATH) at 44,671, and while price action has slightly pulled back, it’s hovering right beneath breakout territory. Bulls will now be looking to see if this rally can build a base above previous resistance or if momentum will stall in the short term. Read More…

Dow Jones Futures (YM) Technical Analysis 3 July 2025

Introduction The Dow is knocking on the door of all-time highs, trading just beneath the ~44,800 resistance zone. With mega-cap indices (like NQ and ES) already in breakout, YM’s late surge confirms a broader market rally, and a potential rotation into industrials and value-heavy components. The weak Dollar is undoubtedly contributing to this. Technical Overview Read More…

Dow Jones Futures (YM) Technical Analysis – May 27, 2025

Technical Analysis Structure and Trend Any clean break above the 200-day MA opens room toward the all-time high (~43,564). A bullish “golden cross” is not yet active, but a sustained breakout could tilt momentum in that direction. Probabilities Scenario Description Probability Targets Bullish Continuation Holds trendline and breaks above 200-MA High 42,557 → 43,564 (ATH Read More…