- Investors focused on potential supply cuts from OPEC+.

- There was a surprise build in US crude oil and distillate fuel stocks.

- The third-quarter growth of the US economy surpassed initial estimates.

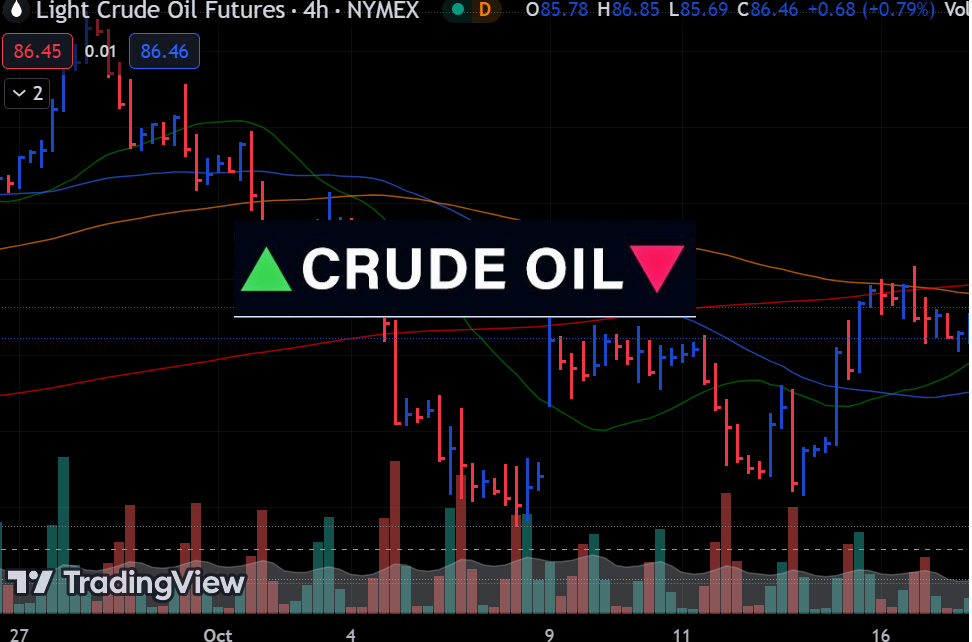

On Wednesday, oil prices surged over $1 per barrel as investors focused on potential supply cuts from OPEC+ and overlooked the increase in US crude, gasoline, and distillate stockpiles. Possible discussions for additional cuts from the OPEC+ group during Thursday’s policy meeting have boosted oil markets. Reports suggest a cut of up to 1 million barrels per day.

Saudi Arabia, Russia, and other OPEC+ members are responsible for over 40% of global supply. They have supply cuts, amounting to about 5 million barrels per day, or 5% of global demand.

Meanwhile, the Energy Information Administration’s recent report indicated a surprise build in US crude oil and distillate fuel stocks, signaling weak demand.

Elsewhere, a severe storm in the Black Sea region disrupted oil exports from Kazakhstan and Russia by up to 2 million barrels per day, causing concerns about short-term supply tightness.

On Wednesday, a Reuters poll revealed that oil prices will likely face challenges in 2024 due to global growth risks, including China’s uneven economic recovery. According to a survey of 30 economists and analysts, Brent crude will likely average $84.43 in 2024. It is a decrease from the October projection of $86.62. Estimates for US crude were also revised downward to $80.50 for the next year, compared to $83.02 last month.

Societe Generale commodity strategist Florent Pele commented, “Between geopolitical tail risks and bearish fundamentals, it is hard for us to be bullish on crude oil.” Benchmark Brent crude has experienced a more than 15% drop since late September due to record US production and concerns about demand.

US GDP (Bureau of Economic Analysis)

Based on data, the US economy grew more than expected in the third quarter, driven by increased construction of warehouses and the accumulation of machinery equipment by businesses. However, recent indications suggest a decline in momentum due to higher borrowing costs.

Oil prices rose by about 2% on Tuesday due to expectations of OPEC+ extending or deepening supply cuts and a weaker US dollar.

The US dollar reached a three-month low on Tuesday after US Federal Reserve Governor Christopher Waller hinted at potential rate cuts in the coming months. A weaker dollar typically boosts oil demand, making dollar-denominated oil more affordable for buyers using other currencies.