- Risk sentiment is improving as US treasury yields fall.

- Manufacturing activity in the US grew slowly, pointing to reduced demand.

- Higher interest rates are discouraging consumers from spending in the manufacturing sector.

E-mini S&P 500 futures prices increased by about 2% on Monday as US Treasury yields fell due to weaker-than-expected manufacturing data, boosting the attraction of stock futures as the year’s final quarter gets underway.

The US futures market has experienced three consecutive quarterly drops in a turbulent year marked by interest rate hikes to contain record-high inflation and worries about a faltering economy.

“The US yield markets (are) pulling back – that’s been positive … and that connotes a more risk-on environment,” said Art Hogan, chief market strategist at B. Riley Wealth in Boston.

The benchmark US 10-year Treasury yield decreased, providing more support for rate-sensitive growth stocks after British Prime Minister Liz Truss had to backtrack on a tax cut for the highest rate.

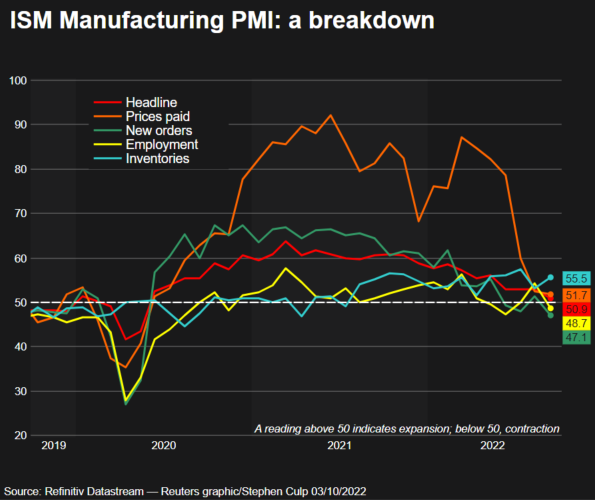

Data revealed that manufacturing activity grew at its slowest rate in almost two and a half years in September as new orders shrank, perhaps because rising interest rates reduced demand for goods.

According to the Institute for Supply Management, this month’s manufacturing PMI fell to 50.9, missing forecasts but still over 50, suggesting expansion. It fell from 52.8 in August to 50.9 last month, the lowest figure since May 2020. According to ISM, the index’s decline “reflects businesses responding to possibly lower demand in the future.” 11.9% of the US economy comprises manufacturing, and a value above 50 implies an expansion in this sector.

Manufacturing has slowed down partly as consumers switch their spending from goods to services. Government figures released last Friday indicated that while spending on services increased, consumption of durable manufactured items hardly increased.

Since March, the US central bank has increased its policy rate from close to zero to the current range of 3.00% to 3.25%, and this month, it hinted that significant additional hikes would be coming this year.

Spending on expensive, often financed items like furniture and appliances for the home is being restrained by the increased borrowing prices. This is what the Fed has been working to achieve. The sooner it achieves its objectives, the sooner it can loosen its monetary policy. This bodes well for E-mini S&P 500 futures prices.