Gold prices soared following a sharp drop in US inflation. China’s senior authorities advocated for more focused restrictions amid a rise in COVID-19. The odds of a fifth straight 75bps Fed rate hike have fallen below 15%. A massive rally in Gold (GC) futures prices occurred following a sharp drop in US inflation data on Read More…

Month: November 2022

Technical Forecast: E-mini Dow (YM) Futures Overbought & Decorrelated

The E-mini Dow has been decorrelated from the overall market this month. The Daily chart shows overbought condition. A small bear flag pattern appears on the Hourly chart. The Dow’s Decorrelation The Dow Jones (YM) Futures has been completely decorrelated from markets for the past month. NQ has fallen by 1% this month, while YM Read More…

China’s COVID Spread Hampering Demand for Crude Oil (CL) Futures

There are increased fuel demand worries as China battles a fresh wave of COVID-19 infections. US crude inventories rose significantly last week as domestic production increased. Markets are anxiously awaiting US inflation data. On Thursday, Crude oil (CL) futures prices declined for a fourth day due to worries that new COVID restrictions in China, the Read More…

NQ Scalper Shares His Funded Trading Strategy

Who Is He & Why He Chose OneUp Trader Zachary B is a futures trader from Texas who completed the $50,000 Evaluation in October of this year. He chose the 50K Evaluation because the contract sizing suited his trading style, and the low $150 monthly subscription appealed to him. Zachary chose OneUp Trader because of Read More…

Equity Index Futures Prices to Rally Ahead of US Mid-term election results?

There is renewed optimism about China easing COVID-19 restrictions. Markets are hoping the recent signs of a slowing US economy will allow the Fed to ease monetary policy. Investors are closely watching the US midterm elections with republican senators in the lead. US Equity Index futures prices, including the E-mini Nasdaq-100 (NQ) futures, rose as Read More…

Technical Analysis: E-mini S&P 500 (ES) Retraces Into Gaussian Channel

ES price retraces into a liquidity zone at the same price as the Gaussian midline. Core inflation (CPI) and year-over-year inflation reports will be released tomorrow. A potential short-term 1-2-3 bearish pattern formation on the hourly chart. Daily Chart Analysis Looking at the daily chart, there are a few developments we can note. Toward the Read More…

Market Actors Remain Calm Ahead of US Elections and CPI Data

Republicans have a roughly 70% chance of ousting Democrats from their majorities in the US House and Senate. Headline US inflation is estimated to have fallen in October to 8.0%. There is a likelihood of a US legislative impasse following Tuesday’s elections. With one cautious eye on a crucial inflation update later in the week, Read More…

Technical Outlook: Gold (GC) Futures Consolidating Between $1,621 & $1,680

Bearish target of $1,622 has been hit. Gold consolidating within a tight zone. Fundamentals playing a big role in the Gold price. Bears Target Hit In the October 28th article, we mentioned the potential for Gold to drop to the support zone at $1,622. As we suspected, the gold price has done just that and Read More…

Canadian Dollar (6C) Futures Prices on the Rise Amid Dollar Weakness

The US dollar declined after the October jobs report showed signs of “softening.” The unemployment rate in the US rose to 3.7% in October. Canadian jobs figures came better than expected, creating further room for the bulls. The Canadian Dollar (6C) futures prices are climbing higher as the CAD strengthens against the US dollar. The Read More…

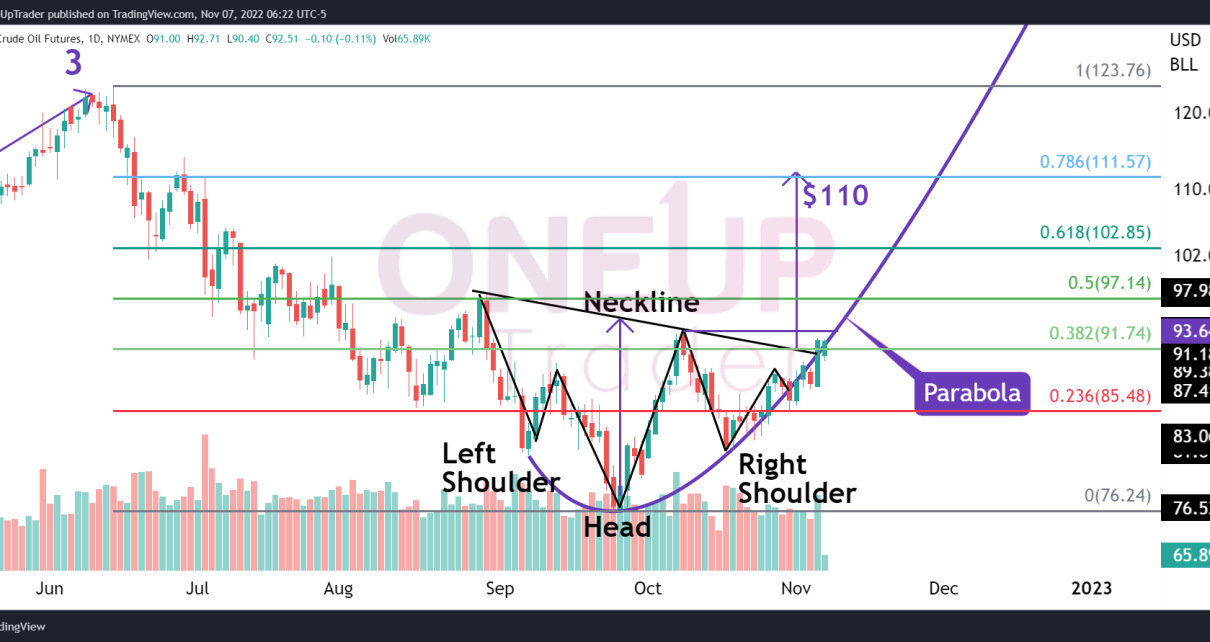

Technical Analysis – Crude Oil (CL) Futures Prices Continue to Rally

CL prices continue to follow the Parabola. The Inverse Head & Shoulders pattern has a chance as the price hovers above the neckline. Technicals point toward a bullish sentiment. Fibonacci analysis and targets if the rally continues. Quick Recap In the previous two articles, the central theme has been the bullish sentiment of CL, mainly Read More…