Introduction In our earlier analysis, I mentioned key levels in CL crude futures, focusing on a support zone between $66-$71 and a potential breakout above $78.04. There was an expectation of a rally towards higher targets if the price successfully broke above the descending trendline and the 100-week EMA. With escalating geopolitical tensions involving Iran Read More…

Tag: stock market

Equities Fall 1% as Markets Dial Back Fed Rate Cut Expectations

Equities fell by 1% on Monday as market participants absorbed the sudden shift in the Fed’s rate cut outlook. At the same time, fears arose that the escalating Middle East tensions would increase oil prices and affect the global economy. On Friday, the US monthly employment report revealed a jump in job growth and a Read More…

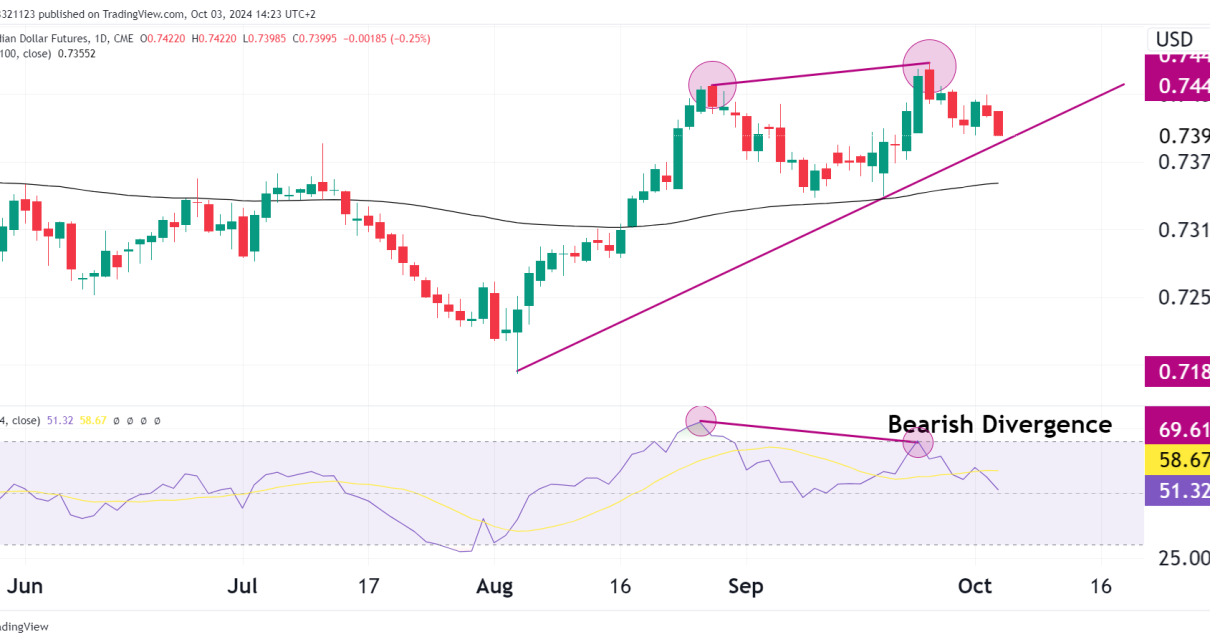

Bearish Divergence on Canadian Dollar (6C)

Introduction We haven’t looked at 6C for a while, but there is an interesting pattern we can look at and learn from. Let’s break down the analysis and find high-probability trade setups while explaining the bearish divergence pattern highlighted in the image. Before we go further, you can learn all about bearish divergence in the Read More…

Karan Is Back With a $28,000 withdrawal One Year Later!

Last year, we introduced you to Karan, a funded trader who withdrew $17,500 from his funded trading account. This year, he is back with another big withdrawal while still trading his aggressive scalping style. Since our last article, OneUp Trader announced that traders could now get funded on up to three accounts at a time, Read More…

Crude Oil prices up 6% on Middle East tensions, technicals point to $78 target

Fundamentals WTI crude futures rose 1.56% to $70.92 per barrel late Tuesday as fears of oil supply disruptions grew after Iran launched ballistic missiles at Israel. Iran fired over 180 missiles in retaliation for Israel’s campaign against Hezbollah in Lebanon, escalating tensions in the oil-rich region. ANZ Research noted Iran’s involvement raises concerns about potential Read More…

Equities Defy Powell’s Hawkishness, Close at All-Time Highs

Equities ended at record highs on Monday despite a hawkish speech from Powell that led to a drop in rate cut expectations. At the same time, market participants were gearingequ up for a new quarter and week packed with critical US economic data. Last week, equities had risen on Friday after US inflation data revealed Read More…