Introduction The S&P 500 E-mini futures (ES) saw its largest single-day drop since April on Friday, October 10, after President Trump announced via social media that he was considering new tariffs on select Chinese technology imports. Now, price is in discovery mode as bulls are seeing this as a possible buying opportunity. Lets take a Read More…

Tag: futures trading

US Equities Slip as Trade Tensions Reignite Ahead of Earnings Season

US equities came under renewed pressure amid escalating tension between the US and China, partially fading yesterday’s optimism. The S&P 500 futures slipped 0.7% while the Nasdaq 100 lost 0.9% amid heightened uncertainty. China’s announcement of retaliatory measures triggered a fresh sell-off. China placed sanctions on five US-linked subsidiaries of South Korean shipbuilder Hanwha Ocean Read More…

Crude Oil Futures (CL) Technical Analysis, 13 October 2025

Introduction Last week, we looked at Crude Oil (CL) Futures, which were testing the support zone between $62.4 and $61. The sideways price action, which was dominating, could be coming to an end as the sellers found the strength to push the price below the level, falling 4.24% on Friday, its biggest drop since June. Read More…

Currency Futures Tumble Amid Cautious Market Sentiment

Currency futures started the week on a cautious note as markets digested fresh US-China trade friction, political chaos in Europe and Japan, and shifting central bank expectations. With a data blackout due to the US government shutdown, the traders are leaning on the policy signals and geopolitical developments to determine the next move. The US Read More…

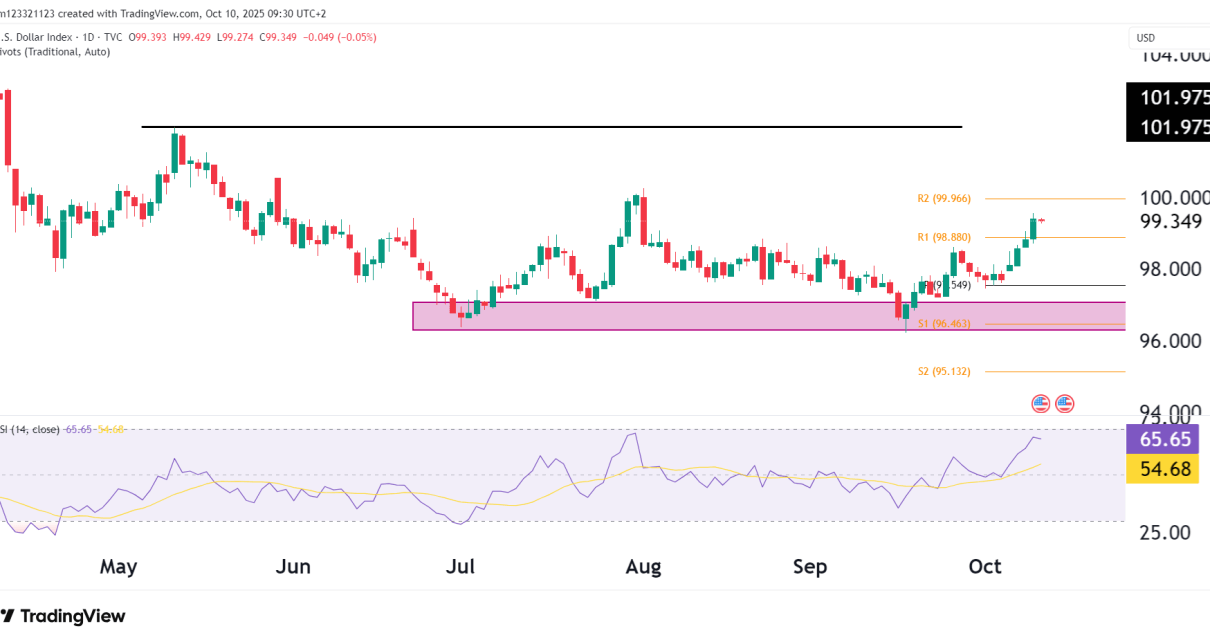

U.S. Dollar Index (DXY) Technical Analysis, 10 October 2025

Introduction The U.S. Dollar Index (DXY) has extended its rally sharply from late-September lows, where price tested a support zone since July. Now hovering near 99.35 after pushing through the R1 pivot at 98.88 and approaching the R2 level at 99.96. The rally is a clean bullish move as price rallied from the support zone, Read More…

US Interest Futures Rise as Fed Signals October Cut

This week, US interest futures are maintaining a delicate balance as markets consider macro risks, inflation signals, and central bank rhetoric. The front end of the curve remains sensitive as investors are pricing in a 25 bps Fed rate cut in October, which reflects easing momentum but not a full dovish commitment. The Fed’s September Read More…