Gold futures rose sharply in Wednesday’s Asian session, with April contracts surging by almost 1% to about $5,170, and spot gold stayed above $5,150 per ounce. The recovery comes after a sharp 4% drop earlier in the week, when a stronger US dollar and fading hopes of near-term rate cuts pushed gold to its lowest Read More…

Tag: futures trader

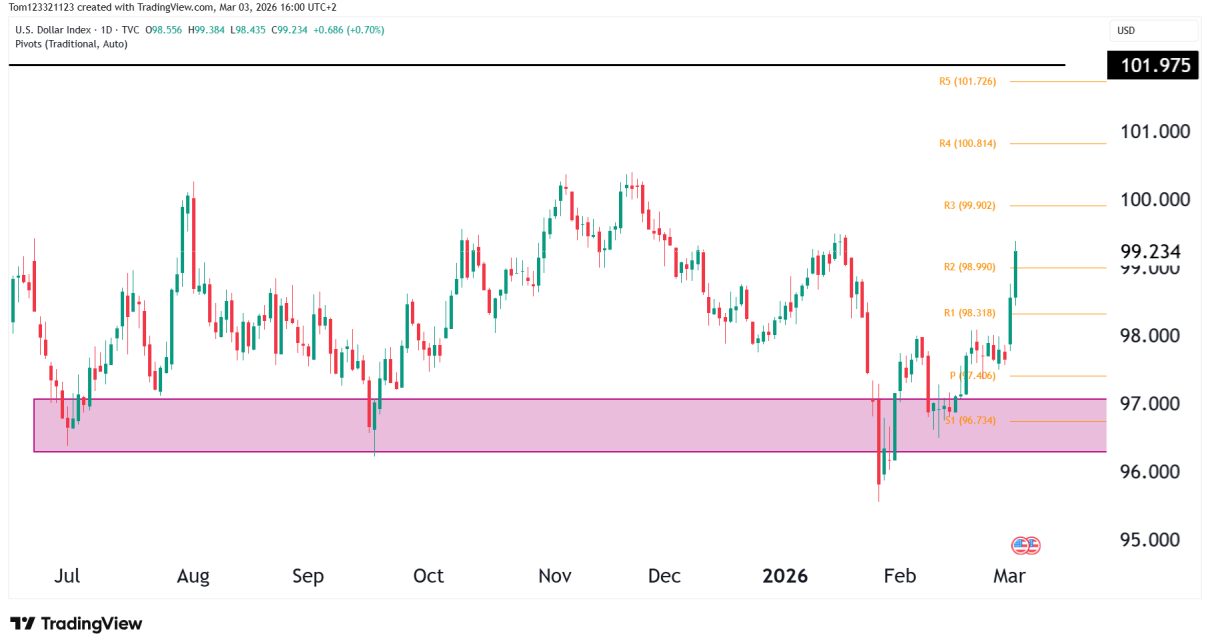

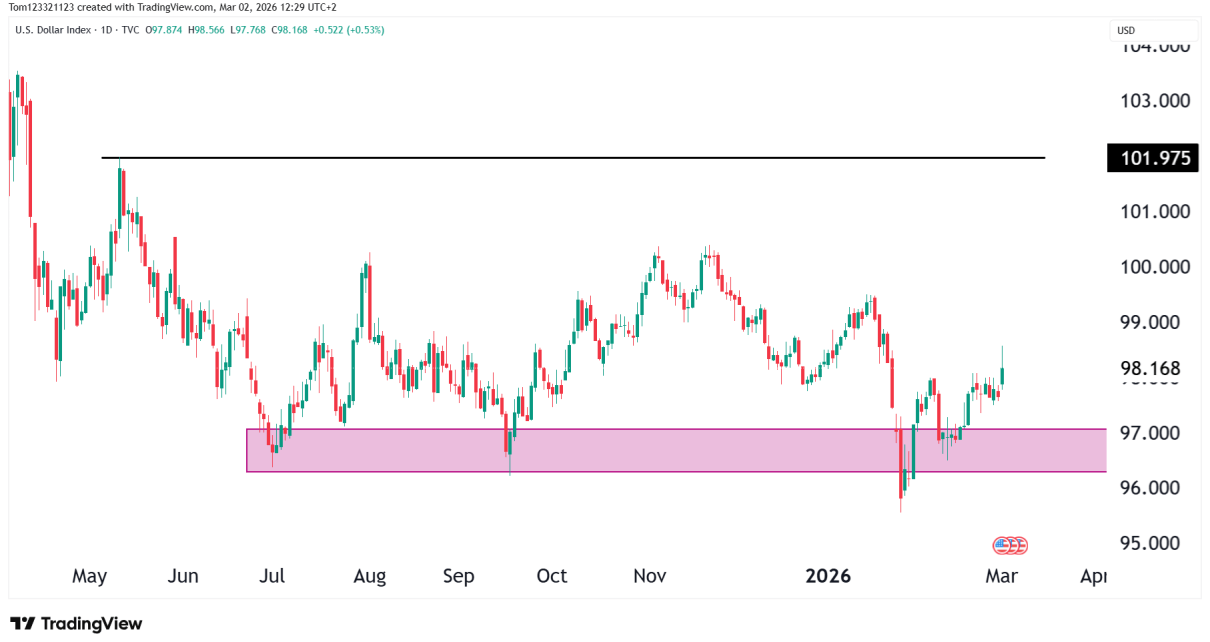

U.S. Dollar Index (DXY) Technical Analysis – Follow-Up

Recap From Yesterday In yesterday’s DXY technical analysis, we highlighted: Today’s price action confirms the bounce is gaining traction. What’s Changed Since Yesterday? Strong Impulsive Move Higher The momentum is accelerating as the conflict in the Middle East continues to escalate. From here, the next most obvious level that comes into focus is the 100 Read More…

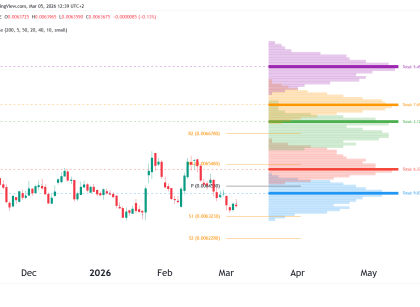

Crude Oil (CL) Technical Analysis – Follow-Up After Breakout

Quick Recap From Yesterday In yesterday’s crude oil technical analysis, we saw a big jump in the price after the weekend’s developments in Iran. Here is a snapshot: The candle from yesterday also closed firmly green after the gap up. After the close, price opened lower but still in the range of the previous candle Read More…

US Equities Weather Iran Shock as Oil Spikes and Data Supports Soft Landing

US equities had a rough start to March, swinging back and forth due to rising geopolitical tensions, even though domestic economic data showed economic resilience. Futures fell sharply at first after the US and Israel bombed Iran over the weekend. This caused oil prices to rise sharply, raising fears of a larger regional war. The Read More…

What Is The Dollar Doing During The Iranian Escalation?

Introduction The U.S. Dollar Index (DXY) had a small uptick in buying pressure after the weekend’s turmoil over the Middle East. Now the greenback is trading at 98.2, and the price spiked 1% after the open. The catalyst is as follows: What Just Happened in the Dollar Index? A lot hinges on the developments in Read More…

24-Year Old Freelancer Withdraws $27,000 Trading Bond Futures

Introduction A 24-year-old trader from Beverly, Massachusetts, has withdrawn $27,000 in just 25 days across 3 funded accounts with OneUp Trader. Trading primarily through a single $50K account and copying them across two other funded accounts, Jack focused on quick scalps in the 10-Year Note (ZN) and 30-Year Bond (ZB) futures markets using the Jigsaw Read More…