MSCI Index Rises and Hong Kong’s Hang Seng Extends Winning Streak The MSCI’s broadest index of Asia-Pacific shares outside Japan saw a slight increase in early trade, while Hong Kong’s Hang Seng index, despite a slight dip, has witnessed an impressive 14% rise over a 10-day winning streak, the longest since 2018. Japan’s Nikkei index Read More…

Tag: E-mini S&P 500 (ES)

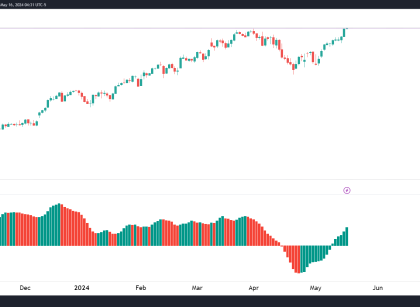

S&P 500 Futures (ES) Technical Analysis: Bulls Are Back

S&P 500 Chart Overview In this analysis, we’ll dive into the daily candlestick chart of the S&P 500 E-mini Futures, focusing on the technicals and chart patterns as ES bulls make a return. ES is up 5% since its low from April and the selling pressure appears to be weaking more and more. Price Action Read More…

Tesla and Apple Lead Rally as Equities End Higher

Equities ended higher on Monday amid earnings optimism and a rally in Tesla and Apple shares. At the same time, investors were preparing for the FOMC policy meeting and the all-important nonfarm payrolls report. According to data, 78.1% of the S&P 500 companies that have reported earnings have exceeded expectations on Wall Street, showing better-than-expected Read More…

Technical Analysis: S&P 500 E-mini Futures: Trade Opportunities

Volume Profile: The High Volume Node (HVN) signifies a price level with substantial trading activity, indicating a strong interest from traders. This level usually acts as a magnet for future price action, drawing prices towards it. The Point of Control (POC) gives the price level with the highest trading volume over the period. It is Read More…

S&P 500 (ES) Technical Analysis as U.S. Economy Grows 2.4%

The U.S. economy continues to expand in Q1 2024, with a projected 2.4% annualized GDP growth, exceeding the Fed’s non-inflationary growth rate. The IMF has raised its 2024 U.S. growth forecast to 2.7%, citing strong consumer spending and a strong labor market, which added an average of 276,000 jobs per month in Q1. Inflation is Read More…

Equities Recover Amid US Earnings Optimism, Easing Middle East Tensions

Equities recovered ahead of major US earnings reports on Monday and as Middle East tensions eased. The rebound comes after six sessions of declines caused by a drop in Fed rate cut expectations and geopolitical tensions. Nasdaq’s losing streak (Source: Bloomberg) Equities had a rough time last week, with the Nasdaq posting big declines as Read More…