Most people nowadays do more cash investments. Cash is essential for us to perform our day to day expenses, including making purchases of all kinds. When you save your money in the bank, you could receive interest on the savings and this is one of the reasons cash investments worthwhile.

As a beginner, it could be quite tricky when deciding on the investment options you have as you might not even know where to start given the multiple types of available classes of investment asset around the world.

In general, there are three major kinds of investments and these comprise of cash, bonds, and stocks. These classes of assets can be beneficial under specific conditions but not so in others. They prove risky is some situations but are high-yielding investment options in others.

Nearly all organizations try to generate income by offering their products for sale or providing services. If a firm cannot generate income, then it is on its way to dissolution especially when the expenses begin to outweigh its proceeds. Hence, several business owners see abundant cash as a good thing, instead of a negative one. But still, a business could be hurt when they have abundant income in some situations.

Several investors believe they need cash only for making unanticipated expenses. This is a false belief as cash plays a crucial function and should form part of everyone’s combined group of assets.

Making sufficient cash available as “spending money,” is definitely essential for every business. Yes, you need cash to settle your monthly bills, little expenses, etc. The asset allocation theory proposes some factors that affirm this necessity, including:

- Years Until Retirement: This factors should really be rephrased as: “years until the money is needed”. The main principle here is that your investment option should become more liquid when you are close to needing money.

- Risk Tolerance: When you are in fright as a result of the poor performance of your investments, then you will be very eager to invest in cash.

- Knowledge And Comfort With Alternative Investments: It is quite unfortunate that several investors have inadequate knowledge of the options they have. They don’t know how to efficiently invest their money in different places and this causes them to have cash and in most times, excess of it.

Cash/Liquid Money Investments

There are generally four options you have when it comes to cash investment and these include:

- Money Market Accounts

- Money Market Mutual Funds

- High Yield Checking Accounts

- Certificates of Deposit

Having a part of your money in liquid form implies that you’ll be able to get cash when you require it to take care of unanticipated expenses and urgent situations. The money you keep in your savings and checking accounts, investments, and liquid assets that you can turn to cash when you are in dire need of it all fall under “cash” asset.

The Harvard Business School advises that you keep your liquid funds in various places. For instance, your checking account should be worth around a month’s pay so that you can handle monthly living costs. You can use an interest-bearing savings account to store cash you reserve for emergencies and you should not see a retirement account as a source of liquid cash since you will face a penalty when you tamper with it before the agreed time.

Additionally, you should not invest your liquid savings in stocks as it is necessary that your emergency fund remains safe from market risk and come with easy access. However, cash investments come with a risk, besides its numerous benefits. We will come to that in a short while.

Recommended Cash Savings Balance

The decision amongst financial professionals differs on the exact amount of money you should keep for emergencies though it is generally advisable that it should be able to handle your expenses for three to nine months at least. I would advise it should serve for up to a year (12 months) at least.

You can arrive at such amount by first determining your estimated expenditure on necessities of life like food, shelter, healthcare, transportation, and miscellaneous expenses. If you, unfortunately, lose your job, these are the main things you will need to daily take care of, so put them into consideration. The unessential wants of life like unnecessary shopping, entertainment, and eating out should not be on the list.

Cash assets and benefits: Why Cash investments look good from afar

Emergency Needs

When you experience emergencies or unplanned events; then you will see that your liquid investments are necessary. Financial professionals say that “people who don’t have a liquid emergency fund are only a paycheck or two away from serious financial problems”. With liquid savings, you don’t have to visit the bank always, or even borrow money on days the bank doesn’t function.

Capital Preservation Or Safety Of Funds

The main benefit of cash is the conservation of capital. That’s another ingenious way of saying that cash is a very secure investment. How is this possible? When you place money in money market funds or certificates of deposit, the Federal Deposit Insurance Corporation (FDIC) normally provides cover for them. This explains that the deposit is covered against loss as the insurance amounts to about $250,000 for a depositor.

Secondly, they are quite safe as they have very low risk since banks use the money from these accounts to invest in stable, short-term and highly liquid securities. These could include commercial paper, government securities, and certificates of deposit (CDs). Immediately the investment time reaches, the bank takes part of the profit and gives you a higher portion of it.

Preservation Of Stock Or Bond Investment

When you have liquid assets, you do not need to sell your assets like stocks or bonds if you experience difficulty and this is a good advantage. For instance, you will not feel happy selling your stock portfolio when you want to support your child’s travels or education. With cash, you can satisfy these kinds of financial duties.

Maturity And Ease Of Conversion

The dictionary defines a cash asset as an asset you can promptly change to cash. Cash equivalents get matured very quickly than other kinds of investments as the duration could be from three months and below. This is an advantage from the business viewpoint since a company can sort their immediate needs with the cash equivalent. Getting a cash equivalent too does not require much stress as you might just have to go make some withdrawals from the bank or other investment homes and that is it.

Financial Storage

There are some cases when a company has spare funds that are not needed for anything at that moment. People regard cash equivalents as very low-risk investments since they have speedy maturity and do not present any difficulty when you want to convert them. You can as well say, “They maintain their dollar value well”. Hence, this implies that a company can put in unassigned funds into several cash equivalents as a means of saving the money until it comes to the point when the company needs it for something.

Enhanced Cash Flow

When a company has a large cash balance, it can control its cash flow properly. Even when there is a drop or delay in income, the business will still be able to settle loans, purchase goods, and pay the employees. The large cash balance represents a cushion and does not need vital supervision, which means financial officers can spend sufficient time in handling other tasks.

Less Borrowing

A business will also not have to borrow funds regularly when it has a large cash balance. There are various reasons a business can borrow money like handling daily purchases, paying staff, investing, etc, so without a large cash balance, it would keep borrowing till it gets into heavy debt and could crash in the process.

Qualification For Loans

In the event of loan seeking, the loan organization checks the company’s finances, including the general cash balance. Apart from borrowing cash to settle the loan’s closing expenses, lenders frequently accept only borrowers who have cash reserves so that the organization does not have the loan as its solitary source of principal.

A business that has enough cash as its reserve will not face challenges when getting a loan and would not even need to get loans. The business can simply use a portion of the cash to either invest in a new means of getting profit or expand to other areas they can make a profit.

Economic Downturns

In periods when the economy begins booming, organizations usually try to develop quickly, hence spending lots of cash. Nevertheless, if an organization expands its cash in such a period will start to suffer and this means it has to sack some employees or find other ways of cutting down costs to remain in business. However, this will not be the case with any organizations that have excess cash as they can use the cash for their development and still have enough in reserve to handle other expenditures.

This is the reason why firms that have saved up enough cash investments can survive recession periods without dropping some employees and with this, they are better off in the competitive world than their competitors when there is finally an improvement in the economy.

Quick Investment Option Decision

This is one of the most important reasons to have cash investments. You could simply stumble upon a very lucrative investment that requires immediate attention and since you have made cash investments, you can simply withdraw some money and key into it. An example is when a certain market crashes and stocks, bonds, or property become very affordable though there are prospects it will rise again once everything stabilizes, then you can quickly organize the cash and invest in the business at a lesser price.

Interest

Apart from the investment, you get when keeping cash investments, you can as well get extra income for your business as it yields interest regularly. Since it is in the account you can access, it doesn’t yield much profit so that could look unwise. However, have you compared the interest you pay when you get a loan? When you do this, you will see that it exceeds what you will get when you have your own money in cash investments together with the interest you get.

The Downsides Of Holding A Large Amount Of Cash Or Cash Assets

Loss Of Tax Benefits

One of the disadvantages of having cash investments is the loss of the tax benefits you get from saving your money in retirement savings accounts. Though liquid assets are fine, their superiority could be too much that it turns bad. You should keep long-term savings for retirement in 401(k) or IRA accounts, so that you can gain from tax benefits. The assets in these accounts are not liquid as you cannot withdraw them anytime and if you do so, you face a penalty. This will make you not want to access them, even when you are in dire need of the cash.

Low Return On Investment Or Accruing Interest

It is said that investors who take great risks usually achieve great results. This implies that great risks mean more profit and lesser risks mean lesser profits and it is a major disadvantage of cash investments.

This is one of the explanations why several investors devote sufficient time in seeking the amount of cash they want to keep as miscellaneous funds. When you invest a certain amount of money, you have put the money to labor, and when there is a large amount doing nothing, then it will not bring interest as it should when working.

Countless cash equivalents like checking accounts give interests, though their interest rates are normally low. The low-interest-rate matches the low risk of cash equivalents and this will result in the cash equivalents struggling to see an increase. Therefore, companies normally steer clear of investing large amounts in cash equivalents and rather just the amount that could handle short-term needs. They go out there, find other investment alternatives that can give them larger returns at the same or lesser time as the cash equivalents maturity duration.

Revenue Loss

Even though cash equivalents let a company address short-term needs, it can be hard to precisely decide what they are. Occasionally, companies discover that that the amount they have mapped out for such emergency events is higher than what they eventually experience due to the instability in market circumstances.

In this vein, the company foregoes probable revenue, as the money which was saved would have been used to get a higher profit somewhere else. Hence, the company should analyze its budget carefully so that this doesn’t happen.

Business Growth Inhibitions

When you have a large cash balance, it hinders the business from growing as this is a major disadvantage. Although it is good for a business to have some reserve as liquid assets, it should put the balance into lucrative utilization by intensifying or expanding the company.

Inflation

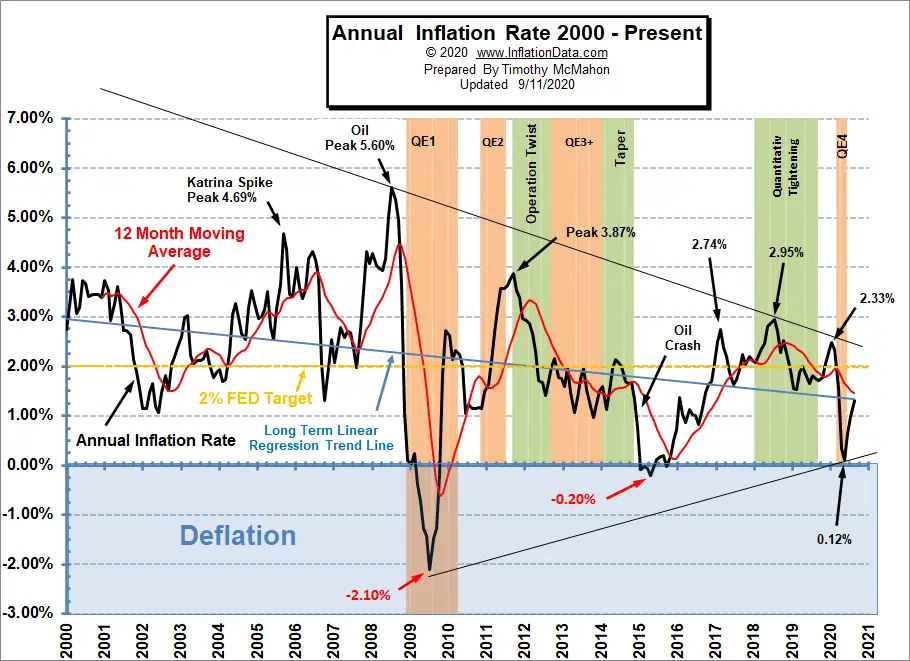

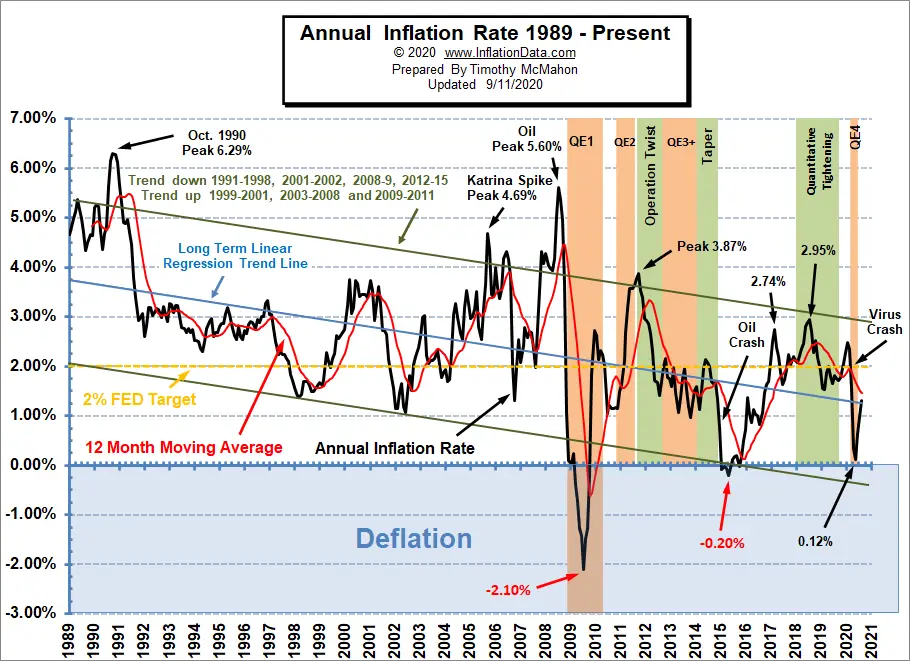

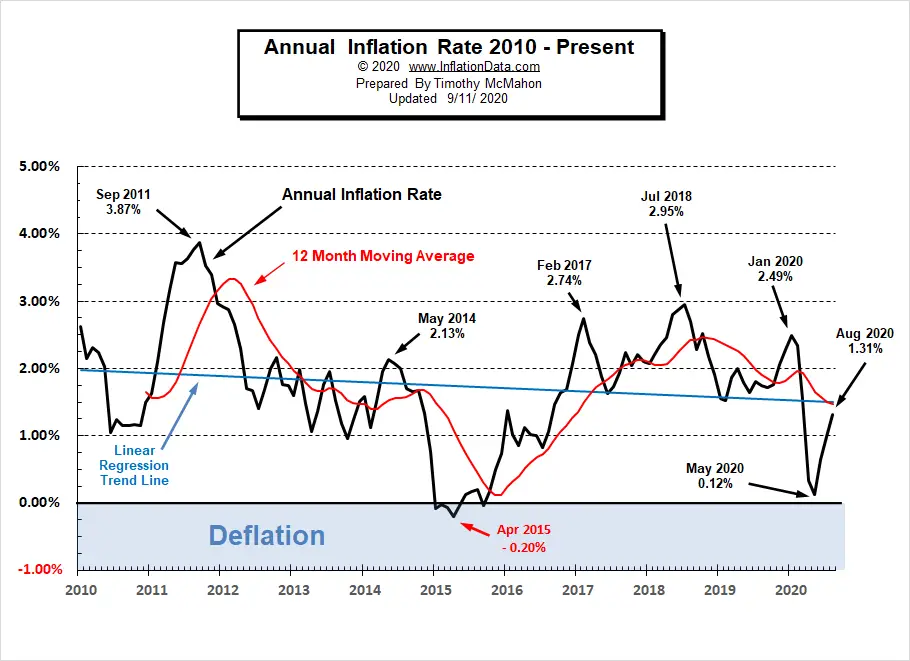

A business can save its cash in the banks or as cash equivalent securities like short-term federal bonds or commercial paper. Since these investments are extremely liquid, the business can retrieve some cash once the needs arise. On the other hand, I mentioned earlier that if you take minimal risks in the world of investment, then you would get minimal profits and this is the case of short-term cash equivalents. They provide low-interest rates and surprisingly, inflation is the biggest risk you can come across when holding cash.

As time passes, the height of inflation wears down the true worth of your cash savings and this will make the organization to keep losing its spending power even though it is losing no money. Hence with more cash in the business’s pockets, there is an increased risk of inflation.

Economists believe in general that when there is abundance of cash in supply, then there would be very high rates of inflation and even hyperinflation. Low or fair inflation might be as a result of changes in actual demand for goods and services. Conversely, the general analysis is that when the supply of money is more than the increase in economic growth, then inflation will drag on for a long time.

Inflation affects economies in different ways that could be positive or negative. Some of these negative effects comprise a rise in the cost of holding money and concerns over potential inflation which may dissuade investment and savings.

What Is Inflation?

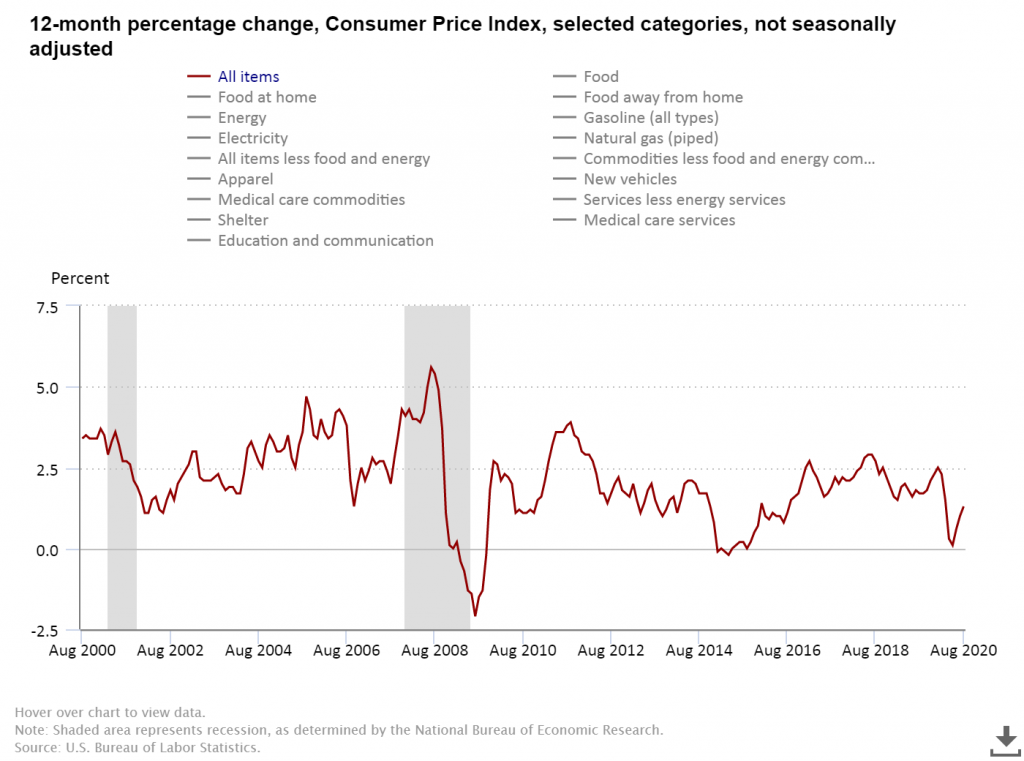

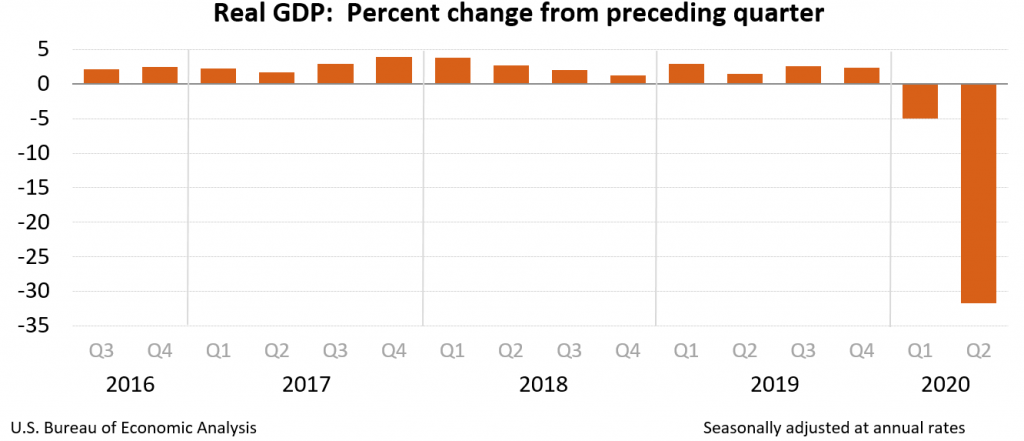

Inflation is the reduction in the purchasing power of a currency. This entails that, when the common price level increases, every financial unit will be able to buy a smaller number of goods and services. Inflation impacts differently on various sectors of the economy, as some sectors experience an unpleasant impact while others benefit from it. The is used to measure inflation, hence, there is an inequality between the money supply and the Gross Domestic Product (GDP).

High or irregular inflation rates are very harmful to an economy generally as they add a high level of incompetence in the market, and make it hard for companies when budgeting or planning for a long-term. Inflation can be a pull on companies’ yield as they are coerced into shifting capital away from goods and services to center on profit and losses from currency inflation.

The insecurity of the potential purchasing power of money dissuades investment and cutbacks. Inflation can as well result in hidden taxes surges. For example, when there is an increase in income, taxpayers will have to pay higher taxes except their tax brackets are indexed to take care of inflation.

Effects Of Inflation On Your Cash Or Liquid Assets

In the United States, as a retiree, you can’t survive on your savings alone when inflation seeps into your yearly purchasing power. This is based on the fact that medical expenses usually rise at a quicker rate than any other expenses.

Also, you do not have to be a retiree for inflation to hit you as it even hit harder when you have not gone on retirement yet. Let’s imagine that you save money regularly to satisfy a particular objective like a college fund for your children or a down payment on a home. This will cause your purchasing power to decline while you are still in the process of saving.

Effects Of Inflation On Saver And Debtors

1. Savers Money Lose Purchasing Power

Inflation causes investors and savers to lose their money’s purchasing power regardless of how much money they have stashed away in a bank or their closet. As time passes, the money loses its value. Hence, this could cause you to expend money or, under the incorrect circumstances, become discouraged to invest your money in things that would serve society for time to come.

2. Transfer Of Money From Savers To Debtors

As an investor, you lose money when the rate of inflation surpasses the interest you are earning on a savings or checking account. However, debtors experience a positive effect of inflation as they could settle their debts with less valuable money.

For instance, if you owed $100,000 at 5 percent interest, but inflation unexpectedly increased to 20 percent per year, you will successfully see that you have settled 15 percent of your debt without moving a brow. With a continuation in the inflation, you could find a job with the least wage of $100 per hour and settle the balance of your debt.

Conclusion

In periods when the economy sees a plunge or the stock market is unstable and leads to a downturn, then you might find yourself seeking ways you can invest your money safely and make good profits.

Cash is an option, although it could probably not grow much as it should when put in other things. When you invest in money market joint funds, you can find it very safe and have your interest in just a short while.

There are also periods when despite the recession or instability in the economy, the money market fund can help you as an investor to safely obtain good profits as it is less risky too.

Despite the cons in cash or liquid asset investments, they still generate profits as it lets investors easily return and adjust to the market when there is an improvement in the economy or a total upsurge from recession. Cash investments when weighed with other joint funds have lesser levels of risk and can be supportive during periods of lingering stock instability. Hence, when making your financial plans, map out some money that would serve as liquid investments.