Blockchain-based digital currencies could revolutionize the financial industry. Cryptocurrencies like bitcoin reverse the traditional modes of transactions between individuals and organizations.

If adopted as an alternative to fiat, they can reduce transaction costs and eliminate the need for intermediaries. This will in turn minimize counterparty risks and stabilize the price. A digital fiat like the dollar, for instance, could democratize the monetary systems and broaden access to the banking system.

The impact of digital currency will however vary given the available multiple design models. While some will only result in the average improvement of the existing system, others would be entirely disruptive in nature. This would mean varying effects on commerce and modes of transaction.

The design model of a digital currency and its influence in the society determines its value and governance structure risks. For instance, there could be liquidity risks if a crypto design didn’t include ways to mint fresh coins when the maximum cap is reached.

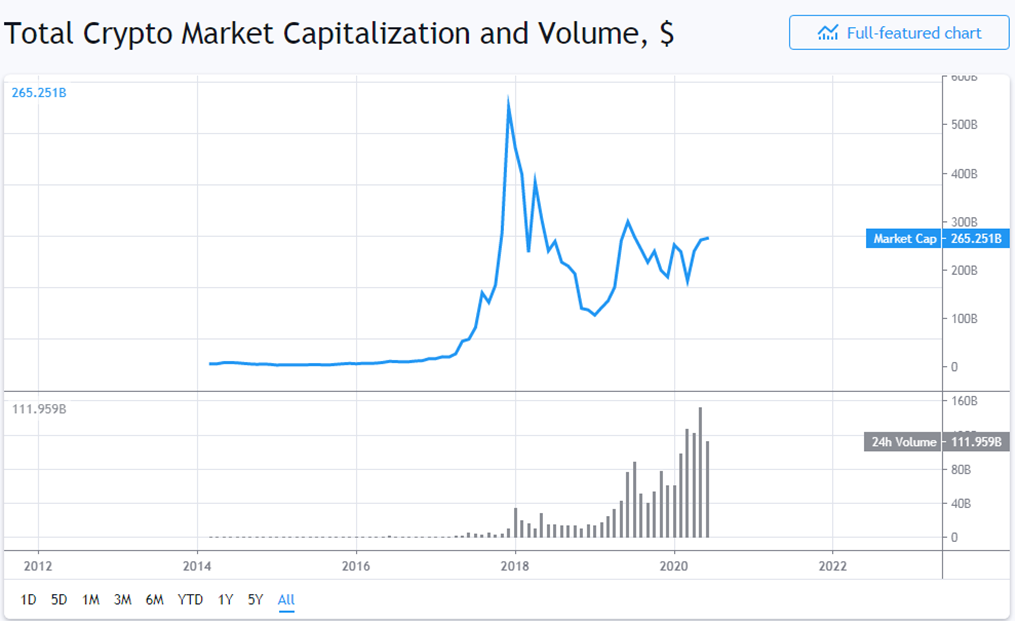

Source: TradingView

If a major world central bank, country, or group of companies launches a digital currency, it may trigger positive responses from others. Although there isn’t yet a one-size-fit-all solution, both governments and private bodies should start now to plan for the future of finance.

Tech-giants and governments are embracing digital coins

Gone are those days when digital currencies like bitcoin are seen as illegal transactions. In the recent past, major tech giants and e-commerce giants like Facebook and Amazon have announced their plans to develop digital currencies.

National governments and central banks are also considering the digital currency option. Central banks of China, Sweden, Canada and more have plans to adopt the digital versions of their fiat currencies. These recent moves indicate a bright future for digital currencies.

Problems with current physical currency models

The rising interest in digital currencies is due to the ability of digital currencies to proffer solutions to some issues with fiat currencies. For instance,

- Clearance of fiat payments can take days as a result of the complex domestic and international transaction settlement processes.

- Unequal transaction fees: SMEs pay higher transaction fees than bigger organizations due to differentials in transaction volumes.

- Limited access to global payment systems by individuals and organizations from emerging markets.

- The high cost of transferring money from one country to the other.

Potential benefits of digital money over fiat currencies

- The digital currencies’ distributed ledger system maintains data integrity and makes transaction authentication possible.

- Fast and real-time transaction settlement.

- Stakeholders can access a complete transaction stream.

- Digital currencies reduce transaction costs and eliminate the need for intermediaries in settlement of transactions.

- Management and storage of fiat currencies by banks are more expensive.

- Digital currencies minimize crimes associated with money and boost economic inclusion for businesses and governments.

- Digital currencies could make the financial system accessible to the previously unbanked population.

- Digital currencies can help countries to improve their tax collection technique and help to track payment.

Classes of digital currencies and why they may be the future of money

Digital currencies come with equivalent features of fiat money including serving as a:

- store of value

- medium of exchange

- stable accounting system

Digital currencies may come with all or some of the features of money depending on their underlying technologies and design. Depending on the value they create, digital currencies are broadly divided into five classes. Each of these classes come with specific roles.

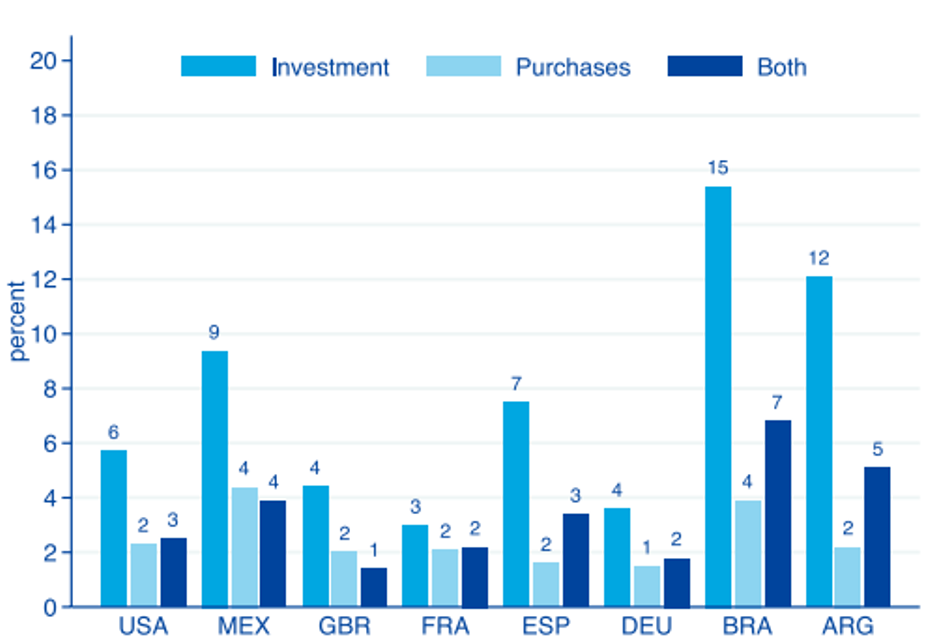

Source: Center For the Governance of Change (CGC)

1. Cryptocurrencies

Cryptocurrencies like Bitcoin, Litecoin, Monero, Dash, and Zcash are originally designed to serve as anonymous means of transactions. However, some of them also serve as investment purposes and act as a long-term store of value.

2. Stablecoins

Stablecoins are digital currencies pegged to specific assets like the US dollar, other national currencies, or commodities like gold.

They can be used to hedge risks and serve as storage of values. These coins facilitate digital/physical transactions. Examples are the Trust Token, USD Coin, and Gemini dollar.

3. Consortium Stablecoins

The operational principles of Consortium Stablecoins are similar to that of Stablecoins. The only difference is that they are issued by a group instead of a single organization. An example is the Facebook Libra planned to serve as a digital currency backed by multiple fiat currencies.

Libra was designed to be backed by the US dollar, the euro, and the Japanese yen, and to operate independently of the regulatory bodies of these countries.

Nonetheless, financial regulators disapprove of this move because of the backing of only a few national currencies and its potential to affect national monetary autonomy.

4. Corporate Currencies

Corporate digital currencies serve the primary purpose of enhancing fast and efficient transactions. Examples are Signet and JPM Coin.

World’s retail giants like Walmart, Amazon, and Rakuten are equally considering the creation of corporate digital currencies to simplify their payment grid.

5. Central Bank Digital Currencies

Central Banks Owned Digital Currencies (CBDCs) are designed to serve as legal tender. These currencies are pegged to fiat notes and serve as a risk-free alternative means of transaction.

They can also assist in the creation of automated monetary policies which would, in turn, minimize hyperinflation risks for developing economies. It will also minimize currency purchasing power disparity.

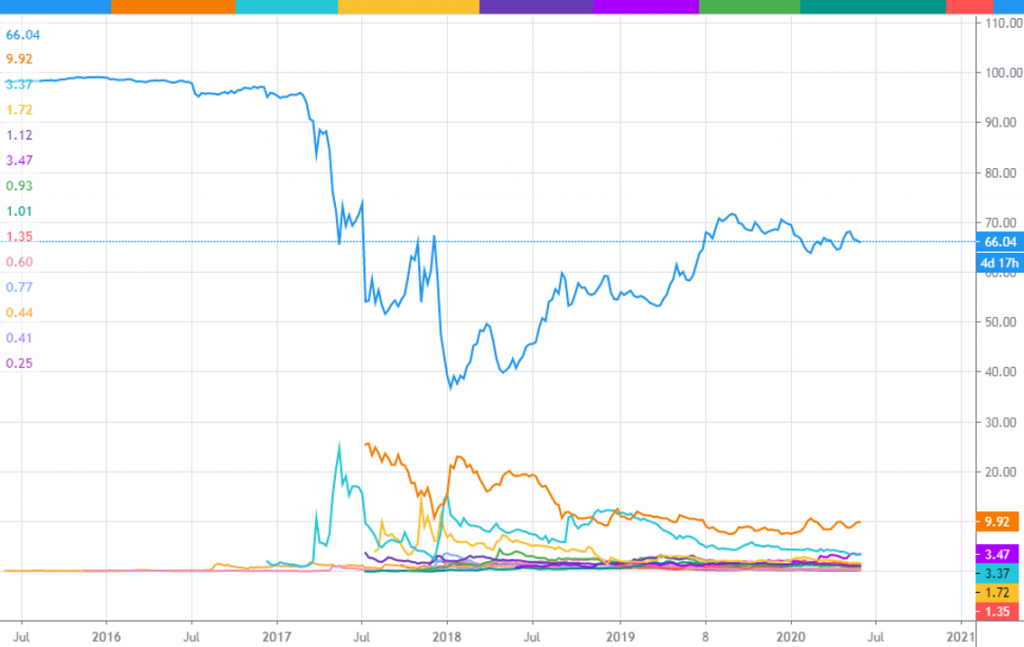

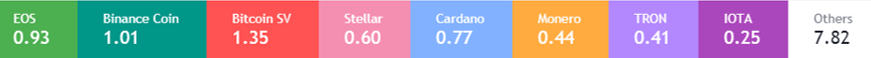

The total market value of different digital currencies (%)

Source: TradingView

Recommended actions for leaders

We foresee that digital currencies will move from experimental models to the mainstream in the nearest future. If this time finally comes, the financial industry will witness significant disruptions.

The impact this may have on the existing financial system may be overreaching. We expect country and organizational leaders to take precautionary actions now. Even if the revolution doesn’t occur eventually as envisaged, a smart step is to start to lay the foundation now.

Organization leaders can:

1. Start to access the strategic and potential disruptive abilities of these digital coins on existing fiats.

2. Create an experimental digital currency and regulatory sandbox to test some promising use cases. It will equally help them gain a better understanding of cryptocurrency designs.

3. Assemble a comprehensive list of business use cases, while bearing in mind end-user benefits like lower transaction costs, faster transaction settlement, convenience, and stability of value.

4. Develop a robust and effective partnership ecosystem and form a clear governance structure.

Conclusion

Digital currencies are making promising moves that could greatly transform the financial industry in the near future. But before this major hit occurs, stakeholders in the financial industry need to start planning for the future.

National governments, private organizations, and central banks need to utilize this period to analyze the possible impact the move may have.

They should also explore the role they want to perform or who they want to collaborate with to ensure optimal benefits and efficient fiat to digital currencies transfer.