Introduction Gold futures (GC) continue to push higher during the crisis in the Middle East as market participants scramble for safe havens. The yellow metal has been an outperformer this year as well as last, and there seems to be no signs of it stopping. Traders who have been looking to buy the dips have Read More…

Technical Analysis

S&P 500 (ES) Technical Analysis 4 March 2026

Introduction S&P 500 E-mini futures (ES) have started to lose upside momentum after repeatedly failing to break the 7,000 resistance zone, which was its all-time high. The market is now drifting lower toward the 6,800 region, with the developments in the Middle East having no major effect on US equities. The strength of the Dollar Read More…

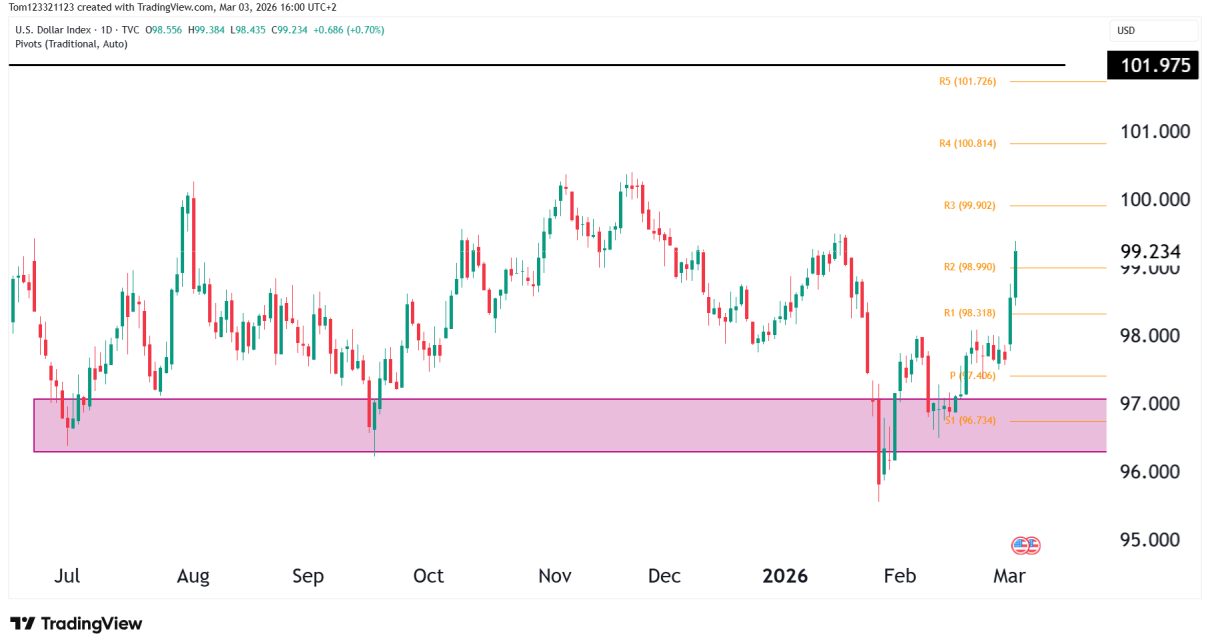

U.S. Dollar Index (DXY) Technical Analysis – Follow-Up

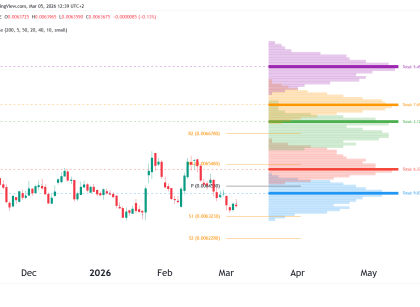

Recap From Yesterday In yesterday’s DXY technical analysis, we highlighted: Today’s price action confirms the bounce is gaining traction. What’s Changed Since Yesterday? Strong Impulsive Move Higher The momentum is accelerating as the conflict in the Middle East continues to escalate. From here, the next most obvious level that comes into focus is the 100 Read More…

Crude Oil (CL) Technical Analysis – Follow-Up After Breakout

Quick Recap From Yesterday In yesterday’s crude oil technical analysis, we saw a big jump in the price after the weekend’s developments in Iran. Here is a snapshot: The candle from yesterday also closed firmly green after the gap up. After the close, price opened lower but still in the range of the previous candle Read More…

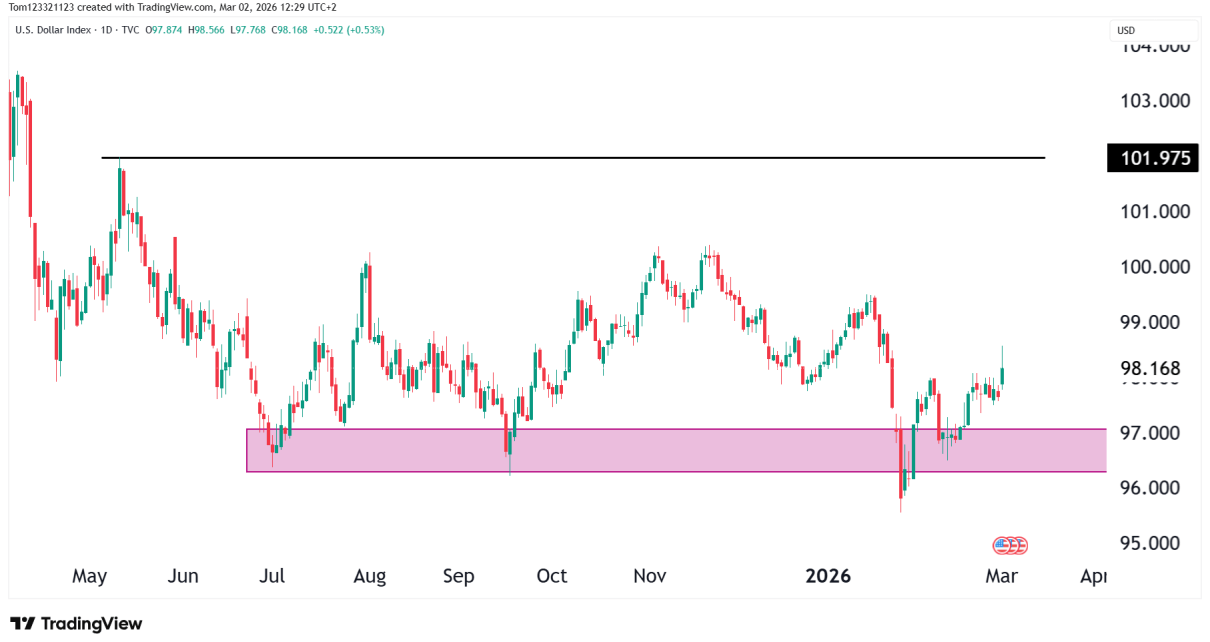

What Is The Dollar Doing During The Iranian Escalation?

Introduction The U.S. Dollar Index (DXY) had a small uptick in buying pressure after the weekend’s turmoil over the Middle East. Now the greenback is trading at 98.2, and the price spiked 1% after the open. The catalyst is as follows: What Just Happened in the Dollar Index? A lot hinges on the developments in Read More…

Crude Oil (CL) Technical Analysis – Middle East Turmoil At Forefront

Introduction After a weekend full of major turmoil in the Middle East, Crude Oil (CL) has exploded higher, rallying 12.54% in early Monday trade. Any further developments of the crisis will be closely watched by investors, and all traders should be wary of the volatile swings we are likely to see in the market this Read More…