- Fed Bank of New York President John Williams stated that the fight against inflation was unsuccessful.

- Investors will keenly monitor the upcoming core PCE price index report.

- Crude inventories rose for the fifth week due to the effects of January’s cold weather.

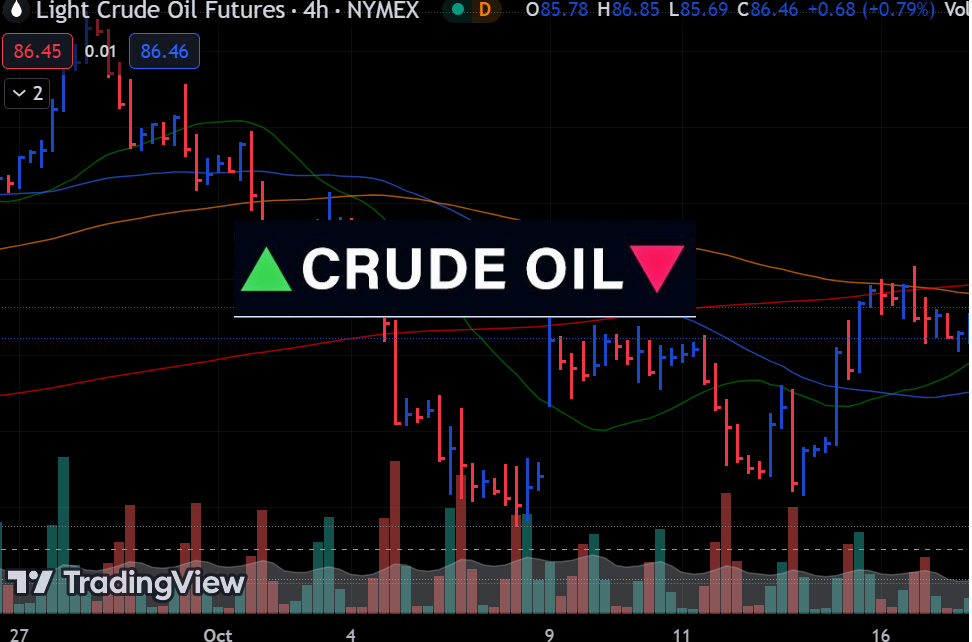

Oil prices closed lower on Wednesday after hawkish Fed remarks reduced rate hike bets. At the same time, there was an increase in US crude inventories last week that put downward pressure on prices.

On Wednesday, Fed Bank of New York President John Williams stated that the fight against inflation was unsuccessful. Therefore, he was not ready to say inflation will sustainably drop to the 2% target. Still, he admitted that it had eased significantly. Fed policymakers continue to dismiss the possibility of a rate hike in the first half of 2024. These hawkish remarks have also led to a decline in bets for a June rate cut.

Notably, on Tuesday, Fed Governor Michelle Bowman said the Fed was in no rush to cut rates as inflation was still a problem. This will likely pressure oil prices because economic growth will slow if borrowing costs remain high, and oil demand will drop.

Consequently, investors will keenly monitor the US’s upcoming core PCE price index report for clues on when the Fed might start cutting interest rates. Oil prices might decline if the report beats forecasts, as it would support the view that high interest rates will stay longer than expected.

WTI futures vs crude inventories (Source: Bloomberg, EIA)

Elsewhere, crude inventories rose for the fifth week as the effects of the January cold weather continued to be felt. Stocks increased by 4.2 million barrels last week, beating expectations. On the other hand, gasoline demand rose for a fourth week, leading to a decline in inventories.

Fed remarks, and crude inventories weighed on oil prices. However, news on OPEC+ output cuts reduced declines.

Support for oil came from reports of a possible extension of OPEC+ output cuts into Q2. In the first week of March, the OPEC+ group will decide whether to extend the cuts, which started in late 2022. The organization began cutting rates to support the market when interest rates rose, and economic growth declined.

This year, oil has gained support from increased geopolitical tensions that have disrupted oil distribution. However, poor economic growth, especially in China, and high interest rates have kept a lid on gains.