- Concerns over the 10-year Treasury yield surpassing 4% led to a surge in the yen.

- In June, the US economy added the fewest jobs in 2-1/2 years.

- The US CPI report might indicate a slowdown in inflation to 3.1%.

Currency futures rose on Friday as the dollar dropped due to indications of a weaker US labor market. This weakness diminished expectations of the Fed maintaining higher interest rates. At the same time, concerns over the 10-year Treasury yield surpassing 4% led to a surge in the yen.

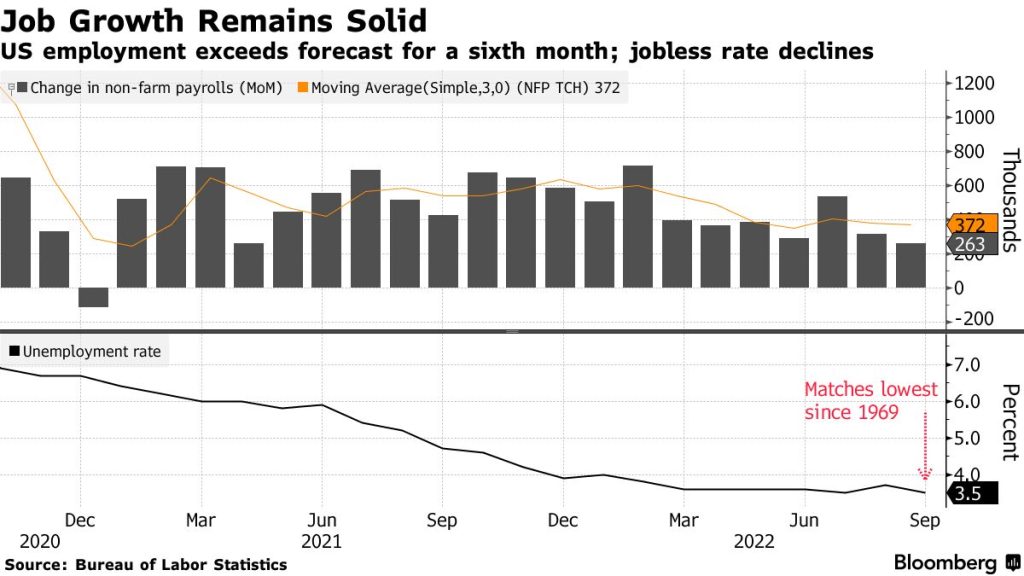

US employment (Source: Bureau of Labor Statistics)

According to the Labor Department, the US economy added the fewest jobs in 2-1/2 years in June. The employment report also revealed 110,000 fewer jobs were created in April and May than previously reported.

Additionally, an increase in the number of people working part-time for economic reasons suggested a weaker labor market. However, job growth remains strong, and with inflation still double the Fed’s target rate, a rate hike this month is probable.

Marc Chandler, from Bannockburn Global Forex in New York, mentioned that markets are closely observing the release of this week’s Consumer Price Index. If the CPI indicates a slowdown in inflation to 3.1%, the likelihood of another rate hike by the Fed, expected in late July, would decrease.

The yen rose by 1.37% to 142.13, reaching a two-week high against the US currency. Joe Manimbo, senior market analyst, stated that the increase in the 10-year Treasury yield above 4% raised concerns that Japan may intervene in currency markets. This, combined with risk aversion as a prevailing theme, makes the market apprehensive that Japan might support the yen by intervening.

Strong US economic data on Thursday pushed short-dated Treasury yields to their highest level since 2007. It indicated the belief that the Fed would likely raise rates by 25 basis points after its two-day policy meeting on July 26. Futures indicate an 88.8% probability of a Fed rate hike following the jobs data.

Elsewhere, the Japanese labor ministry reported the largest annual increase in regular wages in May since early 1995. This strengthened the belief that the Bank of Japan (BOJ) will need to adjust its ultra-loose monetary policy sooner rather than later.

The Australian dollar experienced a slight increase but remains affected by weak Chinese economic data and general risk aversion.