On Wednesday, oil prices broke below the previous session’s lows before closing with gains as supply worries continued. Moreover, oil was set to end the month with a 4.5% gain, marking the third consecutive bullish month. Notably, the oil market has grown tighter due to geopolitical tensions. All meetings to try and pause the Israel-Hamas Read More…

Tag: Futures

NASDAQ Futures (NQ) Trade Opportunities

Weekly Chart Analysis: Key Levels to Monitor: Daily Chart Analysis: Trade Strategy: Before entering any trade, confirm it aligns with your risk tolerance and trading plan. Monitor the trade actively, adjusting stop-losses and targets as the market moves. Stay informed and be ready to act on new information that could influence market direction.

Gold Edges Higher on Rate Cut Speculation, Eyes on Core PCE

Gold prices rose Tuesday as rate-cut expectations rose ahead of crucial US inflation data. The price held near highs, marked last week after Powell’s dovish press conference. Moreover, there was increased demand as central banks continued to buy gold. Despite a small retreat, gold has held near recent highs. March has been a very good Read More…

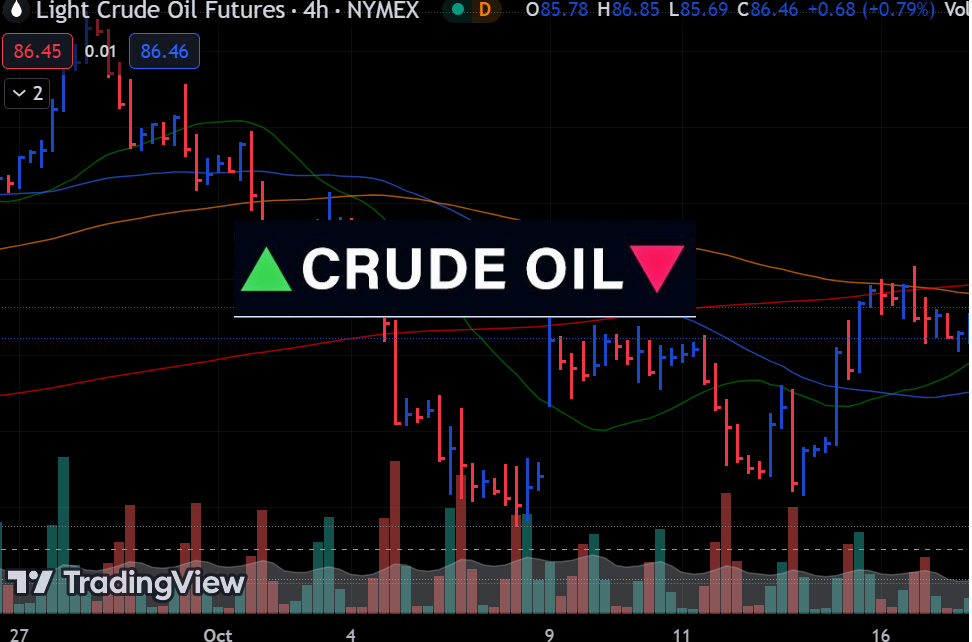

Crude Oil Futures (CL) show continued resilience

Light Crude Oil Futures have been showcasing resilience, marking an upward trajectory after a consolidation phase at a key support level. The weekly chart reveals a rally above the 40-week moving average. The price is trading within the Bollinger Bands, edging closer to the upper band. The RSI on both daily and weekly charts is Read More…

Equities Decline as Investors Digest Fed Remarks

Equities fell on Monday, pausing last week’s rally as investors assessed Fed remarks. The US stock market closed the previous week with gains after the Fed meeting where Powell maintained his dovish stance. Despite the recent hot inflation figures, Powell maintained his outlook for three rate cuts in 2024. However, economic data continues to beat Read More…

Currency Futures Dip Amid Shifting Rate Cut Outlook

Currency futures fell on Friday as the global rate-cut outlook changed. Other central banks are becoming more dovish, leading to an increase in bets that cuts will start this year. Meanwhile, the outlook for Fed rate cuts remains uncertain as the economy remains robust and inflation persists. Notably, the Swiss National Bank opened the door Read More…