US interest futures experienced a decisive reset on Friday as market participants reassessed the Fed’s policy trajectory after the US government shutdown ended. The reduced uncertainty and potential visibility of key data have triggered a divergence between short-dated and long-dated contracts. Short-dated interest futures, such as 2-year Treasury futures and Fed funds, jumped after the Read More…

Tag: Future Trading Tips

Nasdaq 100 (NQ) Technical Analysis 13 November 2025

Introduction The Nasdaq 100 Futures (NQ) are continuing the slow, controlled pullback that began after the index surged to fresh all-time highs in late October. Price action remains consistent with the consolidation described in the previous analysis. Despite recent softness, the uptrend remains intact, with NQ still trading comfortably above its major moving averages. The Read More…

Crude Oil Futures Slip Below $59.0 Amid Mounting Oversupply Concerns

Crude oil futures continue bearish momentum on Thursday, global demand weakens, revealed by rising US inventories, and mounting oversupply concerns next year. WTI crude oil slipped near 0.20% to trade below mid-58.00, extending previous session losses as markets reacted to bearish supply data. The latest API data revealed a 1.3 million barrel rise in the Read More…

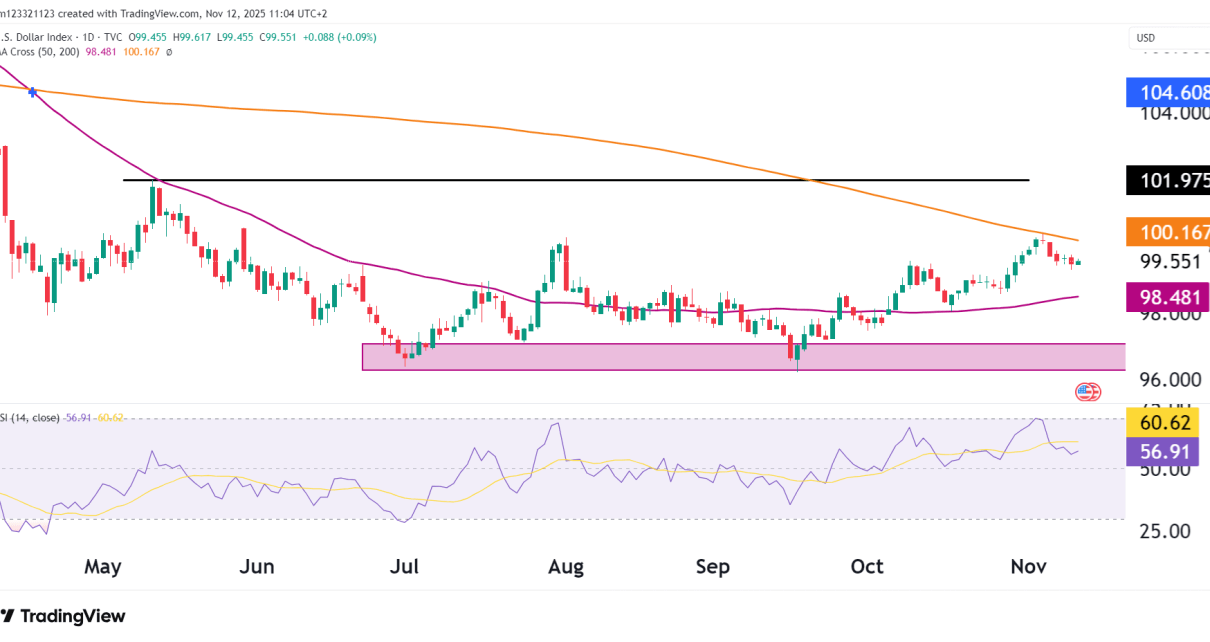

U.S. Dollar Index (DXY) Technical Analysis 12 November 2025

Introduction The U.S. Dollar Index (DXY) continued to rally since our previous analysis and tested the 200-day moving average before touching it and retracing slightly. The greenback’s recovery from October lows and support zone has been hopeful for the bulls; now, they will be looking to clear above the 200-day MA to continue with the upward momentum. Read More…

Gold Futures Pause Rally Amid Dollar Rebound, Government Reopening

Gold futures slipped in Tuesday’s New York session, snapping a 3-day winning streak, as US government reopening optimism eased the safe-haven demand. The precious metal saw profit-taking after surging to a 3-week top above $4,150. During today’s Asian session, the gold futures fell to $4,100 area, weighed by a rebound in Dollar Index (DXY), rising Read More…

Gold Futures (GC) Technical Analysis, 11 November 2025

Introduction Gold Futures (GC) have extended gains since our previous analysis, as buyers regained control following a strong rebound off the 50-day moving average. The yellow metal has now risen for a third consecutive session, suggesting that the recent pullback may have reached a floor near $3,900, where there is some support. Bulls appear to Read More…