Equities had a mixed day on Monday. Major tech stocks dragged the Nasdaq lower, while the S&P 500 and the Nasdaq gained ahead of an anticipated rate cut at the FOMC meeting on Wednesday. Tech stocks performance (Source: Bloomberg) Apple shares dropped by 2.7% after an analyst noted that demand for the iPhone 16 models Read More…

Tag: E-mini S&P 500 (ES)

Equities Rebound 1% as Markets Brace for US Inflation Data

Equities rose 1% on Monday, recovering from last week’s plunge ahead of crucial US inflation data. Investors sold stocks the previous week due to fears about the economy after a set of poor reports. S&P 500 weekly change (Source: Bloomberg) Notably, the manufacturing and labor sectors showed weakness, creating economic uncertainty. However, by Monday, calm Read More…

S&P 500 E-mini Futures (CME, Weekly Chart) Technical Analysis

Current Overview and Market Sentiment:The S&P 500 futures chart is showing signs of exhaustion after an impressive rally over the past two years. As we approach September 2024, the market is showing clear indications of bearish divergence, warning us of a possible trend reversal or significant correction in the coming weeks. Price Action: The S&P Read More…

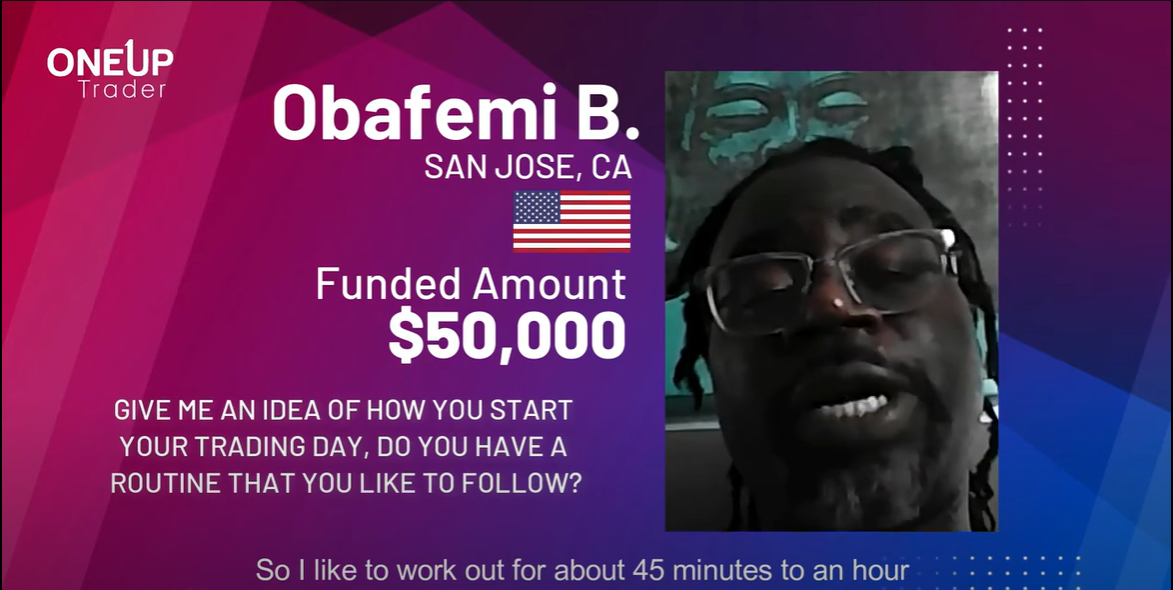

California Trader Conquers Funded Trader Program with Momentum Strategy

Introduction Meet Obafemi, a futures trader from San Jose, California, who successfully completed his OneUp Trader evaluation using a momentum trading strategy. Let’s learn more about this trader’s style, routine and why he chose the OneUp Trader funded trader program. Trading Approach Obafemi’s trading approach can be defined as momentum-driven. He identifies the market’s direction Read More…

Equities Slip After Downbeat ISM Manufacturing Data

Equities plummeted on Tuesday after downbeat manufacturing data sent investors scrambling for safety. At the same time, experts believe the decline came as investors dumped equities at the start of a historically poor month. Data on Tuesday showed a bigger contraction in the US manufacturing sector than expected. The ISM manufacturing PMI showed a contraction Read More…

Bull & Bear Trades in S&P 500 Futures (ES)

Trend Analysis: The weekly chart for the S&P 500 (ES) futures has been surging alongside all other US equity markets since November of 2023. After a recent break below the trend line, the bulls stepped back in, and the price began its upward movement once more. We should not get euphoric though, there is a Read More…