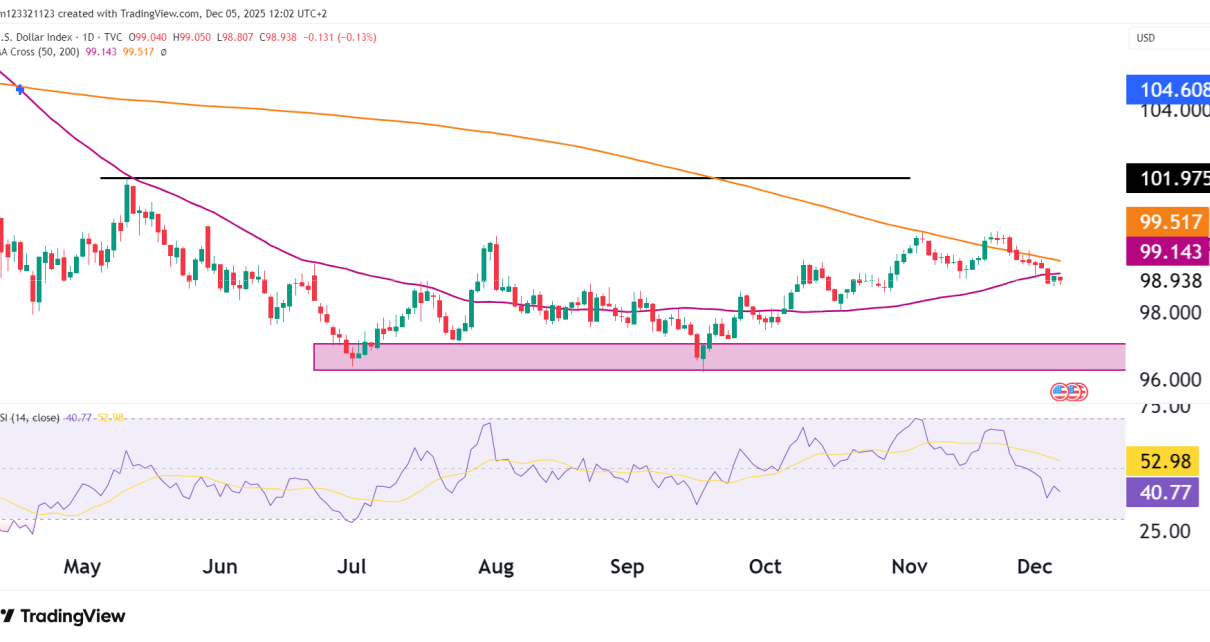

Introduction The U.S. Dollar Index (DXY) has fallen back slightly after rallying 4.4% since September. The 50-day moving average has held the price for the moment, which could lead to a new push back up toward 100. The 50 and 200-day moving averages are also converging, and if the 50 crosses above the 200, it Read More…

Analysis

US Interest Futures Firm Amid Mixed US Data, Shifting Fed Odds

US interest futures remained firm this week, driven by shifting Fed policy, as incoming labor and economic data provided a mixed picture, showing a cooling jobs market but a still resilient economy. The combination keeps traders focused on the final Fed meeting of the year, where markets are now pricing in a 90% probability of Read More…

Dow Jones Futures (YM) Technical Analysis – 4 December 2025

Introduction Dow Jones futures (YM) pulled back slightly, but have been rallying alongside the other US indices. The Dow is 1.3% away from the all-time high, and bulls will be trying to push above that in the next few sessions. Let’s take a look at the technicals and what they are telling us. Technical Overview Read More…

Nasdaq-100 (NQ), Technical Analysis – 4 December 2025

Introduction Nasdaq-100 futures have continued to rally, with 7 out of 9 candles in the green for the past sessions. Price is 3.2% away from the all-time high of 26,404, and bulls will be trying to push through that in the next few sessions. Let’s break down the technicals and see what they tell us. Read More…

Crude Oil Rises as Ukraine’s Strike Triggers Uncertainty

Crude oil futures gained modestly in Thursday’s Asian session, supported by renewed geopolitical worries and a weaker dollar. However, the broader outlook remains capped by the softening demand and rising US inventories. WTI futures hover above $59.00 after a 0.5% gain, while Feb Brent trades just below the $63.00 mark. The recent boost in price Read More…

Gold Futures Consolidate Gains Ahead of US ADP, ISM Services PMI

Gold futures remained firm on Wednesday, consolidating gains as traders await key US releases ahead that could shape the FOMC meeting next week. Gold Feb futures were trading near $4,230, up 0.25%, at the time of writing. The broad futures markets continue to price in a dovish shift from the Fed, while safe-haven demand for Read More…