Crude oil futures traded higher on Tuesday morning as ongoing geopolitical tensions in West Asia continued to impact the market.

Brent oil futures were up 0.29% to $90.64, while May West Texas Intermediate crude futures gained 0.21% to $86.61.

Tensions in the Middle East drove the surge in crude prices. The much-anticipated peace talks between Israel and Hamas in Egypt failed to yield a ceasefire agreement, with Israeli Prime Minister Benjamin Netanyahu vowing to proceed with plans to invade the Rafah enclave in Gaza. Additionally, Iran reiterated its intention to retaliate against Israel following recent attacks on Iranian generals in Syria.

What Does This Mean For Our Trades?

Trade Opportunities:

Long Trades:

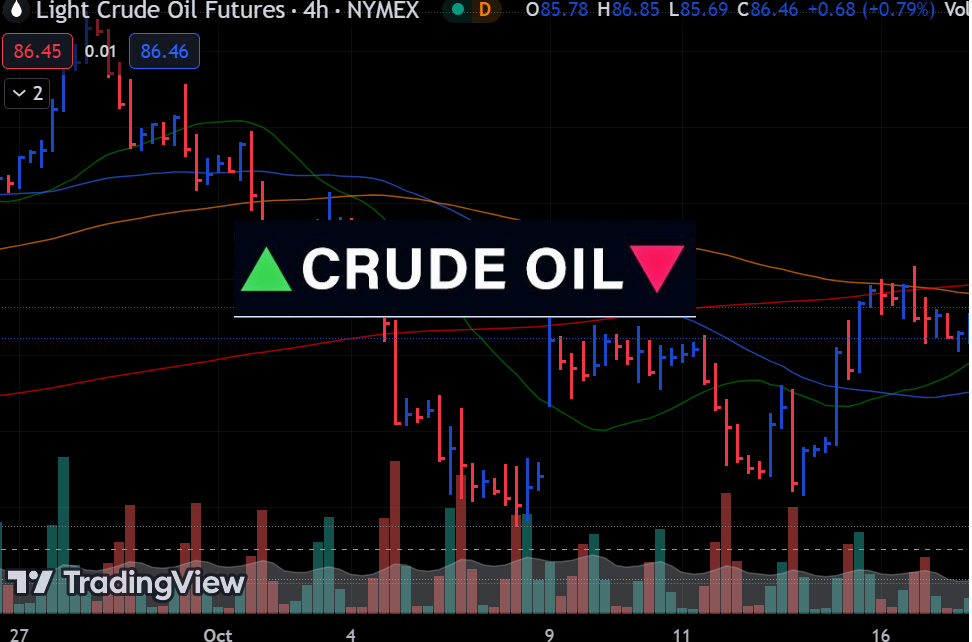

- Consider buying on a pullback towards the Super Trend indicator line or the 50-day Simple Moving Average. These levels may serve as dynamic support, offering favorable risk-reward ratios for long entries.

Breakout Trades:

- A break above recent highs around $86.78 could signal a potential entry for a breakout trade, targeting the next resistance or psychological level at $90.

Technical Indicators:

- The RSI is above the midline but not overbought, which suggests that there is room for upward price movement without immediate concerns about being overstretched.

Stop Loss and Take Profit:

- Stop Loss: A stop loss could be placed below the most recent swing low or the 200-day SMA to protect the trade against a change in the current trend. This depends on risk tolerance and size of the position.

- Take Profit: Setting a take profit at $90 or setting a trailing stop once the price moves favorably can lock in profits while allowing the trade to benefit from further upside.

Ultimately the CL market is in an uptrend and even though we shouldn’t chase the market higher, we should not fight the trend until a clear reversal signal presents itself.