Introduction Crude oil is hovering around $62.30–62.50, finding buying pressure inside of a support zone. After months of steady selling, bulls are starting to find some strength and are looking to push the price back up toward the 50-day SMA. Lets take a deeper look at the technicals and what they are telling us. Technical Read More…

Month: September 2025

Currency Futures Rise as Dollar Resumes Pre-FOMC Slide

Currency futures gained on Monday as the dollar resumed its pre-FOMC meeting decline. The drop in the greenback came as market participants looked forward to Fed policymaker speeches. These speeches could further highlight the central bank’s new dovish tone amid labor market weakness. Dollar Index (Source: TradingView) The Fed cut interest rates as expected during Read More…

Dow Jones Futures (YM): Technical Analysis, 22 September

Introduction The Dow Jones Futures (YM) have been grinding higher, recently printing 46,488 before cooling off slightly. While momentum has slowed, the index remains firmly in a bullish structure, supported by its moving averages and higher highs. Technical Update Trend Support:Price is holding comfortably above the 50-day MA at 45,131 and the 200-day MA at Read More…

Interest Futures Slip as Yields, Dollar Extend Recovery

Interest futures eased on Friday as Treasury yields and the dollar continued their recovery after the expected Fed rate cut. However, the central bank confirmed that it would continue rate reduction for the rest of the year due to the growing risks to the labor market. The anticipation for a Fed rate cut and a Read More…

Nasdaq 100 Futures (NQ): Technical Analysis

Introduction The Nasdaq 100 (NQ) has powered into new all-time highs (ATH), breaking above the 24,068 resistance and climbing to 24,720. The move confirms continued bullish strength in tech, but momentum is stretched, leaving the index vulnerable to a short-term cooldown. Technical Update Key Levels Level Type Note 24,720 Resistance Current high, extension point 24,068 Read More…

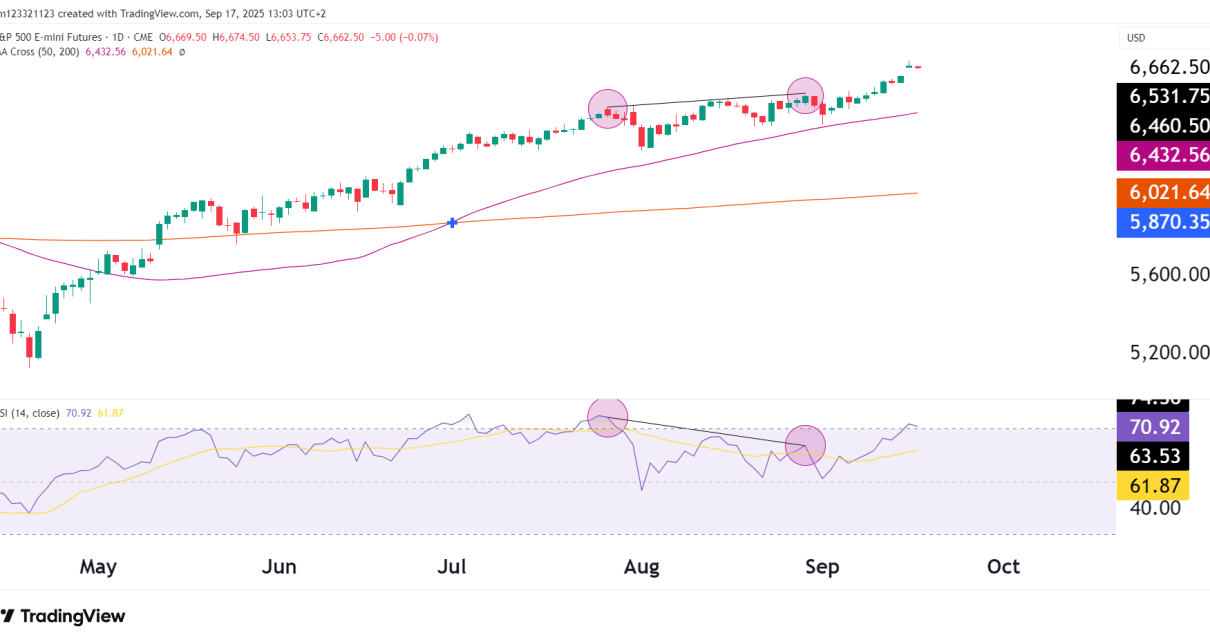

S&P 500 Futures (ES): Momentum Breakout but RSI Overextended

Introduction The S&P 500 E-mini (ES) continues to push higher, posting new gains after bouncing cleanly from its mid-summer consolidation. While the uptrend is intact and strengthening, the market has entered overbought territory on RSI, meaning that the pace of the rally may slow in the short term. Technical Update Trend StructureES has surged to Read More…

Oil Prices Tick Higher as Fed Cuts, Slump in Crude Inventories

Oil prices edged higher on Thursday, a day after the Fed lowered borrowing costs by 25 bps as expected, while markets were optimistic about a fall in crude inventories. However, downward pressure came from concerns about the state of the US economy. After much speculation and anticipation, the Fed finally cut interest rates on Wednesday. Read More…

Equities Climb Ahead of Likely Fed Rate Cut, Tesla Optimism

Equities gained on Monday as market participants eagerly awaited a likely Fed rate cut on Wednesday. However, the outlook for future rate cuts remains uncertain as it will depend on how the Fed views the recent weakness in the US labor market. At the same time, the rally came amid optimism over Tesla stock after Read More…

Gold Lower Amid Profit-Taking Ahead of FOMC Meeting

Gold prices retreated on Wednesday as investors booked profits ahead of the FOMC policy meeting. The decline also came as the dollar strengthened briefly after upbeat retail sales data in the previous session. However, Fed rate cut expectations remained elevated. Gold has rallied to all-time highs in September amid an increase in expectations for lower Read More…

Gold Futures (GC): Rally Stretches Higher but RSI Warns of Fatigue

Introduction Gold has extended its rally, clearing previous resistance levels decisively. However, while the trend remains bullish, momentum indicators are starting to flash potential caution signals. The market is entering a zone where prior rallies have faced profit-taking, making this a key zone to watch. Technical Update Key Levels Level Type Note 3,715 Resistance Latest Read More…