Interest futures were subdued on Friday as Treasury yields remained elevated amid stronger investor confidence in the US economy. Recent progress in trade deals has boosted risk appetite and convinced investors to buy back US assets. At the same time, upbeat data and earnings have pointed to a resilient economy, further supporting yields and weighing Read More…

Month: July 2025

NQ Daily Chart Technical Analysis – July 25, 2025

Technical Analysis After a persistent multi-week rally, the NASDAQ 100 has continued its rally up 42% since the lows in April. The index recently broke above its previous all-time high (ATH), but the current candles show narrow bodies near the upper Bollinger Band, accompanied by a flattening RSI near overbought. Chart Highlights: Macro & Global Read More…

Oil Rises on Optimism Over New US Trade Deals

Oil prices rose on Thursday as the demand outlook improved with the signing of more trade deals between the US and its trading partners. At the same time, the US reported a larger-than-expected decline in crude inventories, indicating robust demand. The latest US trade deal that eased trade war concerns was with Japan. It came Read More…

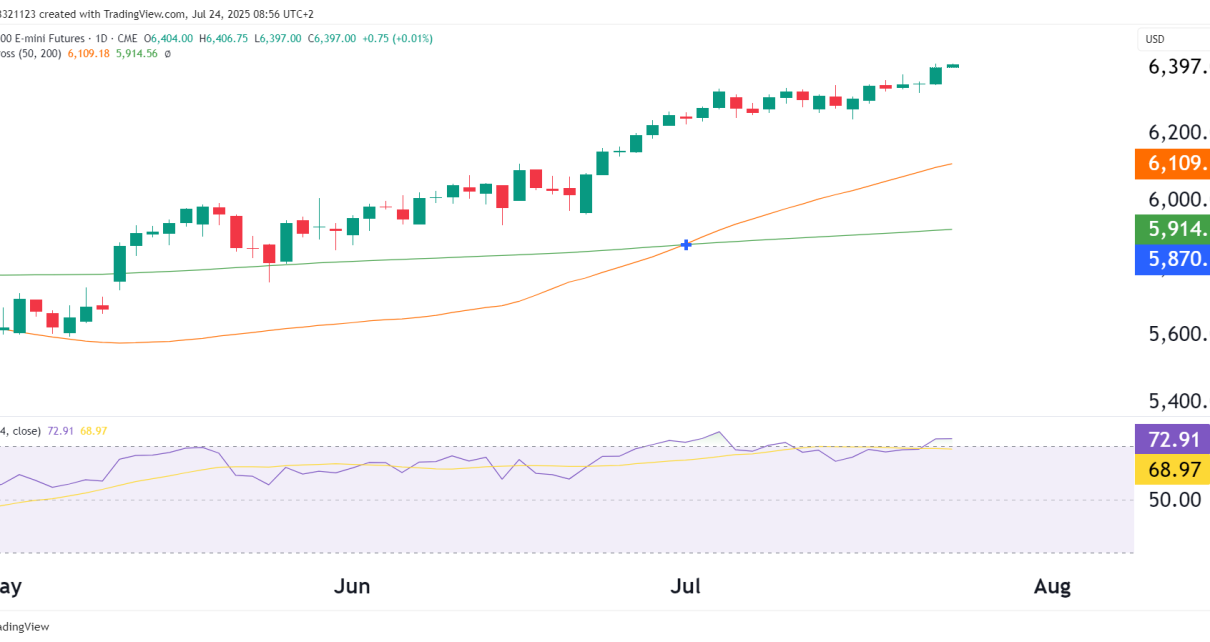

S&P 500 Futures (ES) – Technical Analysis July 24, 2025

Introduction Previous analysis: ES Futures Analysis – July 14, 2025 The S&P 500 futures continue with the strong uptrend, now reaching new all-time highs with barely any pullback since the mid-June breakout. The weakening US Dollar undoubtedly is impacting this. The daily RSI has just breached 72.91, entering overbought territory. When the RSI is at Read More…

US-Japan Deal Dulls Safe-Haven Appeal, Weighs on Gold

Gold prices edged lower on Wednesday after news of a trade deal between Japan and the US eased some tariff uncertainty. However, the move was brief, and gold held near the highs reached in the previous session, amid fears of a looming trade war. Gold has rallied this week as investors sought safety amid tariff Read More…

Gold Futures (GC) Technical Analysis – July 23, 2025

Previous update: Gold Technical Analysis – July 15, 2025 Recap & Context In the last update, we noted that Gold was compressing along trendline support and the 50-day moving average, forming a higher low setup just under the ATH zone. Today, we are seeing confirmation: GC has surged above the pivot level of $3,345.6, tagging Read More…

Equities Hit Record Highs on Q2 Earnings Optimism

Equities hit record highs on Monday, fueled by optimism for the Q2 US earnings season. Market participants are less concerned about tariffs due to strong consumer spending data. Still, uncertainty about tariffs remains a concern as the new August 1 deadline nears. The second quarter earnings season has started, and traders are looking forward to Read More…

Crude Oil Futures (CL) Technical Update – July 22, 2025

Recap from Last Update In our July 10th article, we highlighted the $67–$69 resistance-turned-support zone as the key zone to be focused on. We also noted the looming Iran-Israel geopolitical risks, which created temporary volatility but failed to produce a lasting trend shift. Since then, CL has remained range-bound, and as of today, it’s pressing Read More…

Currency Futures Rise as Dollar Rally Takes a Breather

Currency futures gained on Monday as the dollar paused last week’s rally, with market participants weighing the outlook for Fed rate cuts. Even the yen gained after Sunday’s election, which led to a loss of majority seats in the Upper House for the ruling party. Last week, most currency futures eased as the dollar gained. Read More…

Milwaukee Banker Withdraws $19,500 Using Support & Resistance

Introduction In Milwaukee, Wisconsin, a 30-year-old banker named Chee has quietly pulled off what many overcomplicate: consistent profits using the simplest of strategies. Since joining OneUp Trader, Chee has withdrawn a total of $19,500 across multiple funded accounts, and most recently, $14,500 in a single account within just 9 trading days using nothing more than Read More…