Crude oil prices rose further in Thursday’s Asian session as the U.S.-Iran conflict worsened, tightening supply expectations and halting flows through the Strait of Hormuz. Brent crude rose more than 2% and was trading close to $83 per barrel. Meanwhile, WTI rose toward $76.60, adding to an 11% rise earlier in the week. The geopolitical Read More…

Tag: Futures

Gold Futures (GC) Technical Analysis 4 March 2026

Introduction Gold futures (GC) continue to push higher during the crisis in the Middle East as market participants scramble for safe havens. The yellow metal has been an outperformer this year as well as last, and there seems to be no signs of it stopping. Traders who have been looking to buy the dips have Read More…

S&P 500 (ES) Technical Analysis 4 March 2026

Introduction S&P 500 E-mini futures (ES) have started to lose upside momentum after repeatedly failing to break the 7,000 resistance zone, which was its all-time high. The market is now drifting lower toward the 6,800 region, with the developments in the Middle East having no major effect on US equities. The strength of the Dollar Read More…

Gold Futures Surge 1% as Middle East Tensions Intensify Energy Shock, Inflation Risk

Gold futures rose sharply in Wednesday’s Asian session, with April contracts surging by almost 1% to about $5,170, and spot gold stayed above $5,150 per ounce. The recovery comes after a sharp 4% drop earlier in the week, when a stronger US dollar and fading hopes of near-term rate cuts pushed gold to its lowest Read More…

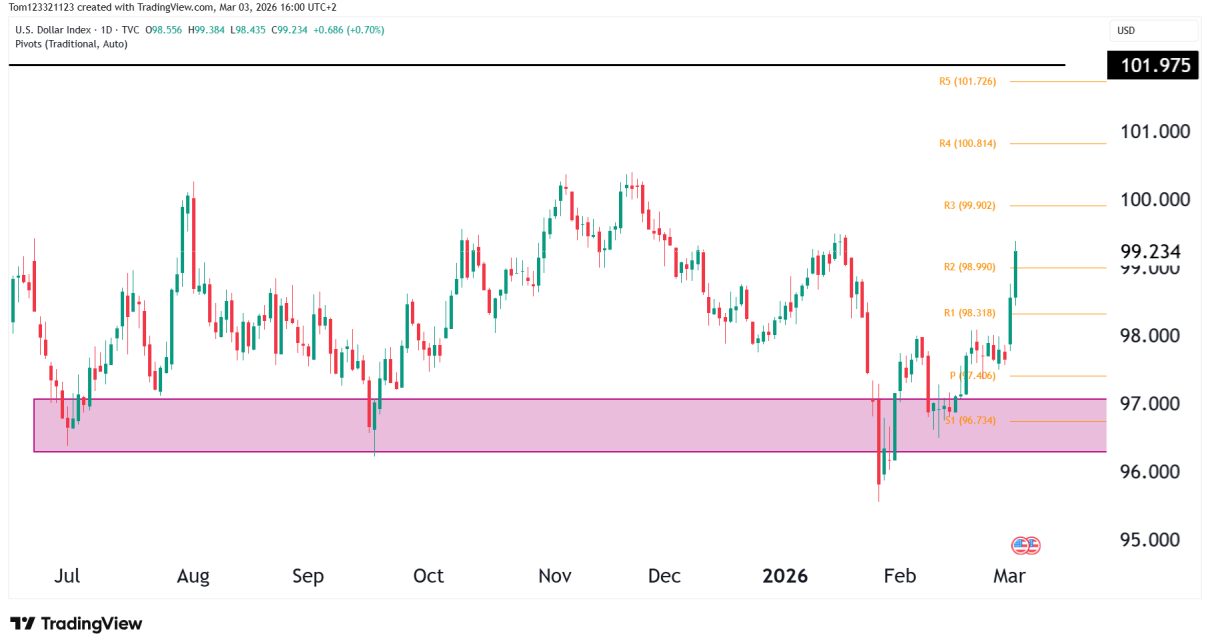

U.S. Dollar Index (DXY) Technical Analysis – Follow-Up

Recap From Yesterday In yesterday’s DXY technical analysis, we highlighted: Today’s price action confirms the bounce is gaining traction. What’s Changed Since Yesterday? Strong Impulsive Move Higher The momentum is accelerating as the conflict in the Middle East continues to escalate. From here, the next most obvious level that comes into focus is the 100 Read More…

Crude Oil (CL) Technical Analysis – Follow-Up After Breakout

Quick Recap From Yesterday In yesterday’s crude oil technical analysis, we saw a big jump in the price after the weekend’s developments in Iran. Here is a snapshot: The candle from yesterday also closed firmly green after the gap up. After the close, price opened lower but still in the range of the previous candle Read More…