Key Takeaways Understanding Risk Rules in Funded Trader Programs Funded trader programs like OneUp Trader allow traders to trade with capital and buying power that otherwise would be very difficult for them to attain. Some accounts allow traders up to $250K and a 25-contract max position size. On top of that, traders never risk their Read More…

Tag: Future Trading Strategies

Currency Futures Tumble as Greenback Soars Amid Middle East War

Currency futures saw significant volatility at the beginning of the week as the US dollar strengthened amid investor flows toward a haven. Geopolitical tensions in the Middle East were the main reason behind the move. Investors turned to the greenback amid rising tensions between the US and Iran. The US Dollar Index (DXY) rose to Read More…

Bitcoin (BTC) Technical Analysis 6 March 2026

Introduction Bitcoin futures (BTC) have been under heavy pressure since the late 2025 highs, with price falling sharply from the $120,000 region down toward the $60,000–$70,000 demand zone. BTC is down 44% since October of 2025. The sell off accelerated through February, pushing BTC well below its key moving averages and confirming a clear loss Read More…

S&P 500 (ES) Technical Analysis 6 March 2026

Introduction The S&P 500 E-mini futures (ES) continue to consolidate below the all time high of $7,000. The sideways price action has been going on since October of 2025 with no real signs of it coming to an end any time soon. Even the escalation in the Middle East hasn’t touched the US equity markets Read More…

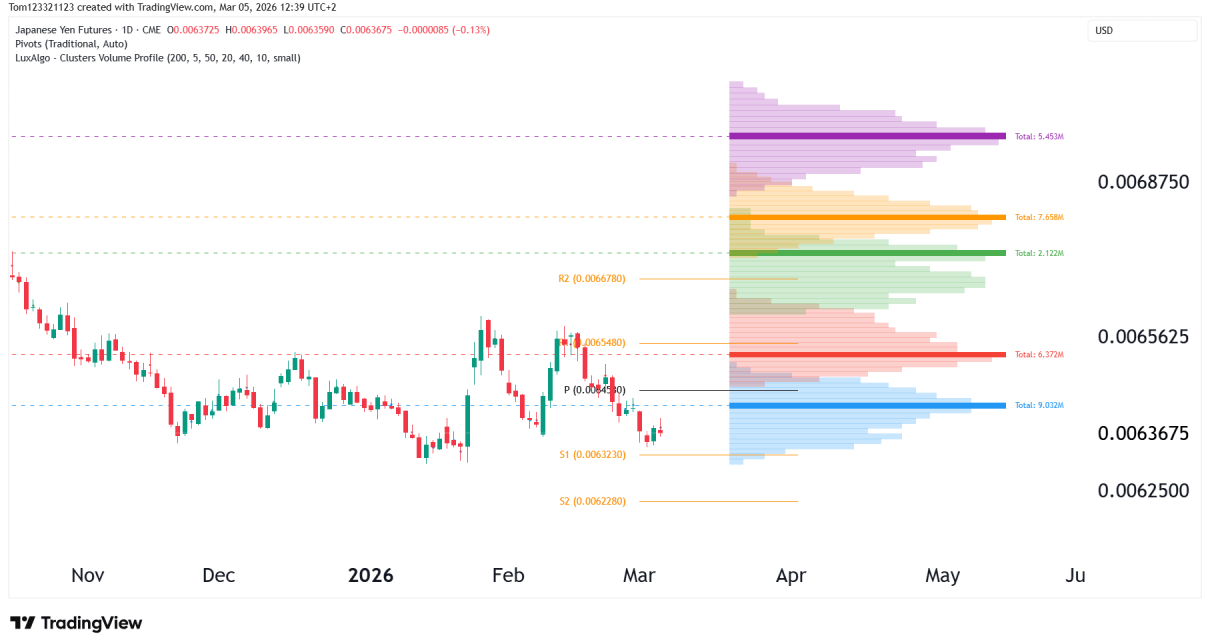

Japanese Yen Technical Analysis 5 March 2026

Introduction The reason we are looking into the Japanese Yen futures (JPY) today is that there could be a high probability of a bullish trade. We are currently testing a major long-term support zone near 0.00630–0.00635, an area that has held since July 2024. With the current situation in the Middle East, this could be Read More…

Crude Oil Tests Multi-Month Top as Iran War Escalates

Crude oil prices rose further in Thursday’s Asian session as the U.S.-Iran conflict worsened, tightening supply expectations and halting flows through the Strait of Hormuz. Brent crude rose more than 2% and was trading close to $83 per barrel. Meanwhile, WTI rose toward $76.60, adding to an 11% rise earlier in the week. The geopolitical Read More…