Introduction The Nasdaq 100 continues to grind higher, notching fresh all-time highs above the previous ATH at 22,425, confirming the bullish breakout structure discussed in our previous analyses. While price action remains strong, momentum indicators are showing signs of fatigue, which could hint at a short-term breather. Key Technicals Probability Table Scenario Estimated Probability Key Read More…

Technical Analysis

Russell 2000 Futures (RTY) Technical Analysis – July 16 2025

Introduction Russell 2000 E-Mini Futures (RTY) are trading at 2,213.3, down slightly by -0.23% on the day. After a strong multi-week rally off the April lows, price has paused and is now pulling back from the 2,230s, testing the 200-day MA and previous minor resistance-turned-support near 2,212.7. Its a important level to watch to see Read More…

Gold Futures (GC) Technical Analysis – July 15, 2025

Introduction Gold futures (COMEX: GC) are holding firm near $3,371.80, up +$12.70 (+0.38%) today, as price action tightens just beneath the all-time high (ATH) zone and continues to respect the rising trendline support. There is a large ascending triangle forming, and if the bulls can maintain momentum, then a break above the all-time high is Read More…

S&P 500 Futures (ES) Technical Analysis – July 14, 2025

Introduction The S&P 500 E-mini futures (ES) remain in a strong uptrend, currently trading at 6,282.50, just shy of the recent all-time high breakout level of 6,380.50. While bulls maintain control, today’s chart shows the index pulling back modestly, hinting at some momentum exhaustion near the highs. Despite the softness, the price remains well above Read More…

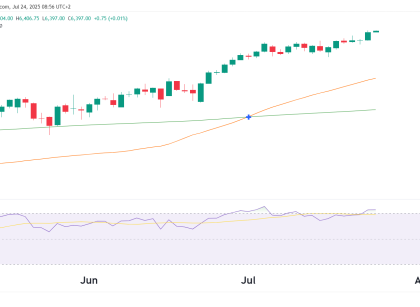

Bitcoin Futures Break Above All-Time High

Catch Up: Previous BTC Technical Review – June Analysis Bitcoin CME Futures have broken decisively above the previous all-time high (ATH) at $112,110, trading at $118,840 with a strong +4.36% daily move. This marks a major technical breakout as bulls surge past psychological resistance, powered by a falling dollar, growing ETF inflows, and broad risk-on Read More…

Crude Oil Futures Technical Analysis – July 10, 2025

🔗 Previous Technical Analysis: Crude Oil Analysis – June 25, 2025 WTI Crude Oil Futures (CL) are holding just above a multi-month support zone, with price currently trading around $68.07, slightly below the 200-day moving average. After recent whipsaw volatility and a brief spike above $75, price has stabilized above the longstanding $66–$68 range, which Read More…