Introduction The S&P 500 E-mini futures continue to grind higher, pressing into the all-time high resistance zone just below 7,000. Price is holding here after dropping below the 50 moving average and immediately bouncing back with a bullish engulfing candlestick pattern. Buyers are still in control, but upside momentum is slowing as prices stretch and Read More…

Analysis

Tech Rebound Lifts US Equities as Investors Brace for Critical Data

US equities extended their rebound on Monday. Gains were led once again by beneficiaries of big tech and AI as investors looked past last week’s turbulence. They turned their focus to a heavy slate of economic data and corporate earnings. The S&P 500 rose about 0.5% to 6,964.82, marking a second straight increase. The Dow Read More…

Light Crude Oil Futures (CL) Technical Analysis, 9 Feb 2026

Introduction Light crude oil futures remain in recovery mode after rebounding sharply from long-term support in the mid-$50s. Price has reclaimed the $60 handle and is now consolidating just below the 200-day moving average. This marks a shift in behavior from persistent selling to selective buying. The market is no longer in a breakdown phase, Read More…

Currency Futures Remain Cautious, Awaiting US NFP, CPI Releases

Currency futures markets started the week in a cautious tone as traders positioned around shifting central bank expectations and delayed US data. The price action shows investors moving away from safe-haven dollar exposure toward selective risk trades. Meanwhile, the rate cut timing remains a key macro driver. The Dollar Index (DXY) extends losses in Read More…

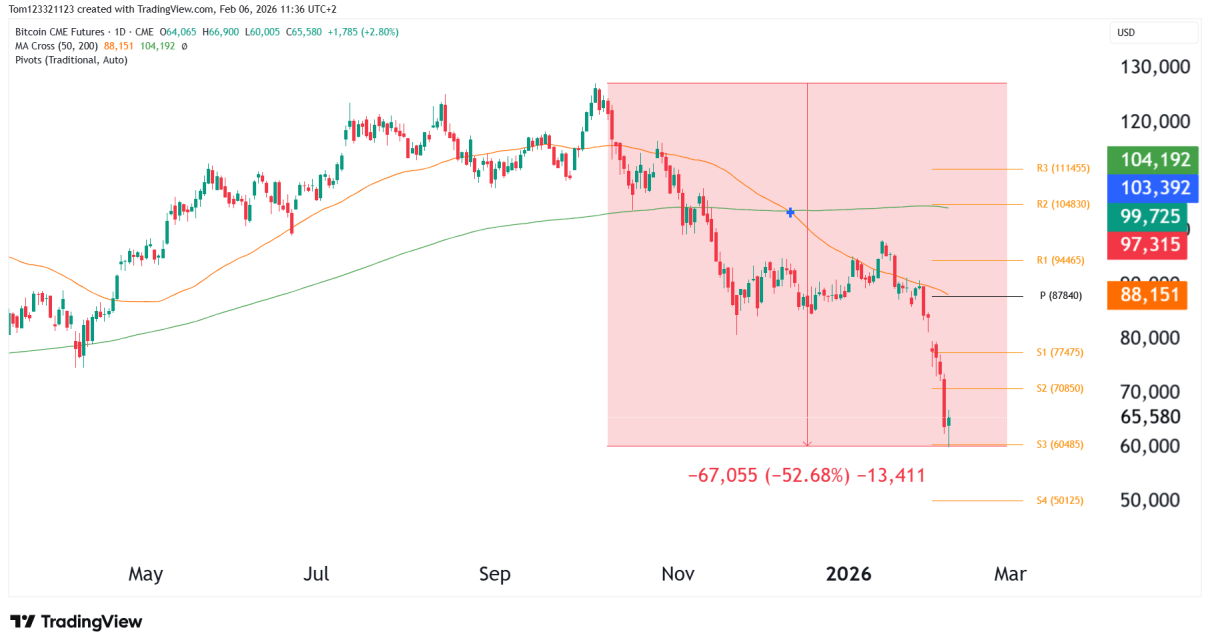

Bitcoin (BTC) Technical Analysis, 6 Feb 2026

Introduction Bitcoin futures have suffered a sharp and violent selloff, erasing months of gains in a matter of weeks. After topping near the $125,000 area, BTC collapsed more than 50% at its worst point before finding temporary stabilization near long-term support. Like with all cryptocurrency moves, it was a volatile one, and panic selling set Read More…

US Interest Futures Signal Slower Cutting Cycle Amid Resilient Economic Growth

US interest futures fell slightly on Thursday as traders backed off bets that the Federal Reserve would cut rates more aggressively later in 2026, after economic data revealed significant improvement. The CME Group’s 30-Day Federal Funds futures prices indicate the decreased probability of more than one cut since last week. Contracts ending in September and Read More…