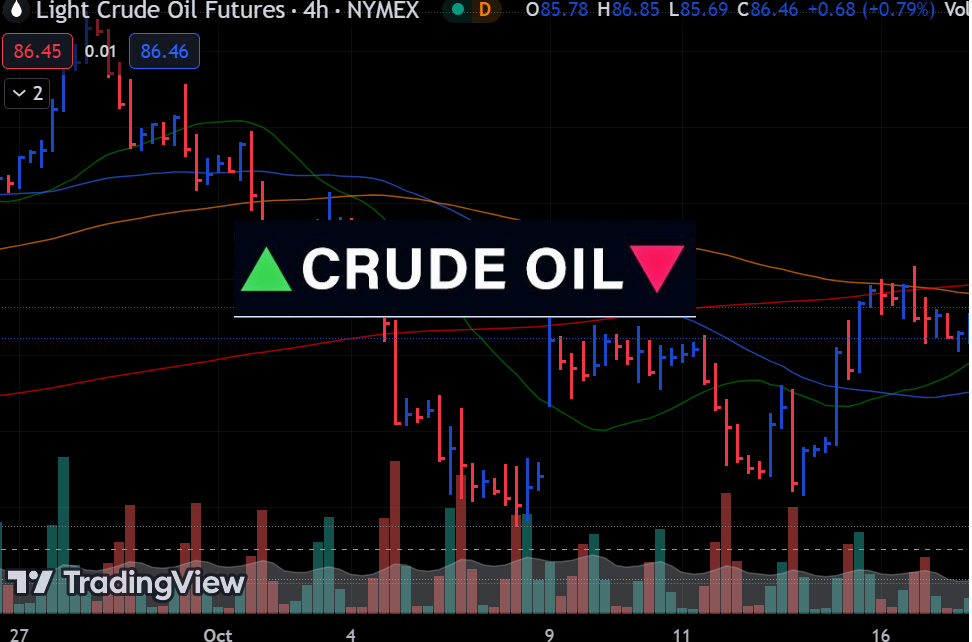

On Wednesday, oil prices increased by approximately 2% due to concerns about conflict in the Middle East. However, higher US crude inventories and gloomy economic prospects in Europe capped the gains. Price Futures analyst Phil Flynn mentioned that prices initially dropped during the session but rebounded due to increased geopolitical risks. WTI Futures (Source: Nymex) Read More…

Fundamental Analysis

Equities Soar on Robust Earnings and Bright Outlook

On Tuesday, equities rose thanks to strong corporate earnings and optimistic forecasts, boosting investor risk appetite and sparking a broad market rally. All three major US stock indexes moved higher, largely driven by large-cap companies sensitive to interest rates. Meanwhile, benchmark Treasury yields remained stable, comfortably below their recent peak at 5%. The third quarter Read More…

Equities Close Mixed as Benchmark Treasury Yields Dive

US equities fluctuated and closed with mixed results on Monday as benchmark US Treasury yields dropped from 5%. Investors turned their attention to high-profile earnings and closely watched economic data for the week ahead. The S&P 500 index finished modestly lower, while momentum stocks sensitive to interest rates lifted the tech-heavy Nasdaq Composite Index higher. Read More…

Currency Futures Edge Up Amid Reduced Fed Rate Hike Expectations

Currency futures ended slightly higher on Friday as the dollar weakened on reduced bets for a Fed rate hike in December. ING analyst Francesco Pesole noted that the dollar was not benefiting as much as it should from strong US data and its high rate advantage, likely due to its overbought status. The dollar weakened Read More…

Middle East Tensions Boost Safe Haven Gold

Gold rose for the third consecutive session on Thursday due to increasing Middle East tensions, driving up demand for safe-haven assets. Moreover, Federal Reserve Chair Jerome Powell’s comments fueled optimism that the US central bank might pause rate hikes. Meanwhile, Israel conducted more airstrikes on Gaza, with British Prime Minister Rishi Sunak echoing US President Read More…

Oil Prices Soar 2% on Storage Drawdown and Supply Fears

Oil prices surged by approximately 2% to reach a two-week high on Wednesday. This increase was driven by a larger-than-expected drawdown in US oil storage and concerns about global oil supplies. During the week ending on October 13, US Energy Information Administration (EIA) reported that energy companies removed 4.5 million barrels of crude oil from Read More…