Weekly Timeframe Analysis:On the weekly chart, we can see price has been in a solid uptrend since the beginning of the year. The Relative Strength Index is currently in overbought territory. Despite the overbought RSI, we should consider the prevailing uptrend as the dominant force until price action suggests otherwise. Daily Timeframe Analysis:The daily chart Read More…

Technicals get out of hand in S&P 500 futures (ES)

Weekly Chart Observations: ES has been getting out of hand lately and just continues to rally no matter what. The Alligator indicator has the Lips (4821.50), Teeth (4733.71), and Jaw (4631.17) fanning out, which confirms the trend strength. Taking shorts now is highly risky and the only thing that could stop this market from going Read More…

Crude Oil futures gear up for bullish breakout

Weekly Chart: The price action is hovering above an established multi-year support zone that is the main point for the bull’s case. The Alligator indicator shows the Jaw, Teeth, and Lips converging, signaling a potential consolidation phase. However, with the price maintaining levels above the Alligator’s Lips, we maintain a bullish outlook. The RSI is Read More…

Bulls target $2,600 in gold futures (GC)

Weekly Chart Analysis:The weekly chart shows a consolidation below the previous all-time high (ATH) with most dips generally being bought back up. The resistance level to watch is the previous ATH at $2089.0. A decisive weekly close above this level could signal a bullish continuation, potentially targeting the bull target zone around $2400.0. However, should Read More…

S&P 500 still bullish as traders buy above all-time high

S&P 500 (ES) Weekly Chart Analysis: The S&P 500 E-mini Futures have demonstrated a robust uptrend, reflected in the rising channel on the weekly chart. The market recently pushed through the resistance marked by the previous all-time high, establishing a significant bullish sentiment. Current resistance sits at the upper boundary of the channel near the Read More…

T-Bond futures: multi-timeframe analysis

Weekly Chart On the weekly chart, bond buying is evident as the yields have continued to decrease since 2020. The RSI has moved above the neutral zone and is sitting at 53.19. The weekly does not give much clues about where we could see it moving in the near term and is neutral. Daily Chart Read More…

Bulls hit first Dollar target, what now?

Weekly Chart Starting with the weekly chart, the Dollar has shown significant strength. Bulls have clearly taken control as indicated by the 4 weekly green closes in a row. We have successfully reached our first bullish target at 103.821, from our analysis last week. The current movement suggests that we could see further upside momentum, Read More…

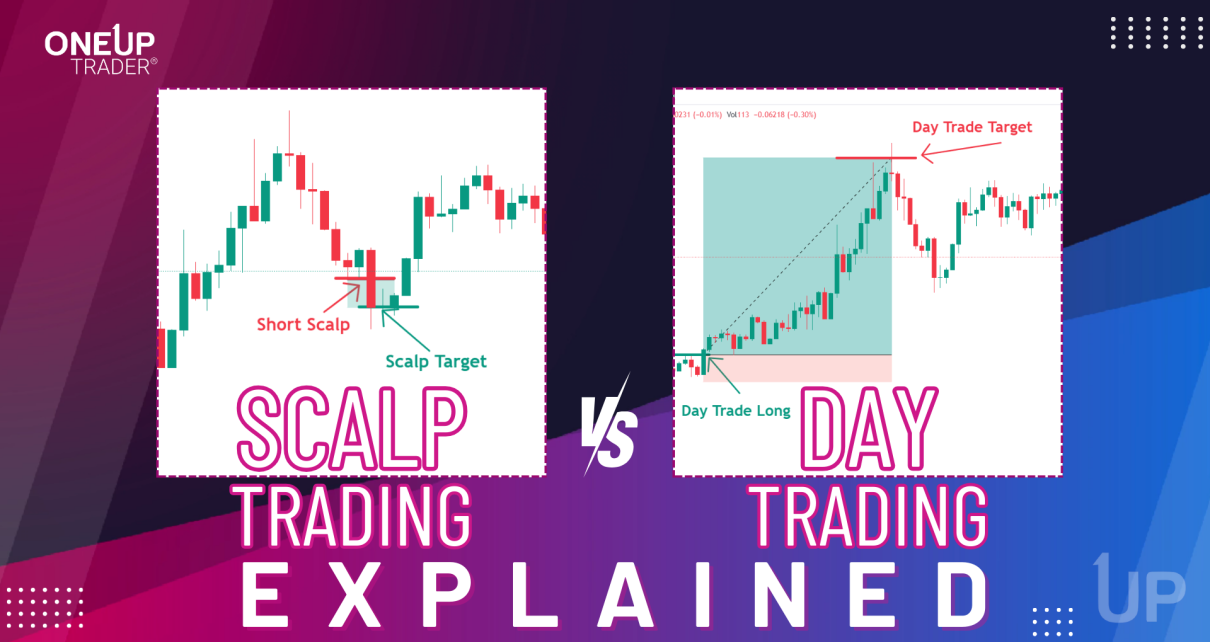

Scalp Trading vs Day Trading Strategies

Introduction to Scalp Trading and Day Trading Scalp trading and day trading are two prominent trading strategies with very distinct approaches. Scalp trading involves making many trades in a single day to capture small price movements. It requires close market monitoring and high precision. Day trading refers to buying and selling financial instruments within the Read More…

Euro Bears Start Taking Control (6E): Technical Outlook

Weekly Chart Analysis for EURO FX Futures:The weekly chart shows price oscillating between a tight range of support and resistance. The Moving Average Convergence Divergence (MACD) is flat and close to the zero line, indicating a lack of strong momentum in either direction. The support zone around 1.05900 is critical, and a break below would Read More…

NASDAQ Futures (NQ) firmly bullish

Weekly Chart Analysis for NASDAQ 100 E-mini Futures:The weekly chart shows price in a clear ascending channel pattern, with NQ positioned in the upper half of the channel. The Relative Strength Index (RSI) is sitting in overbought territory, however. The all-time high (ATH) stands as the ultimate resistance level, which price has closed above in Read More…