Bulls may be targeting the top of the medium-term downward channel. A look into the consolidation zone ES has been trading within. Bullish candlestick formations on the monthly chart. Price Rallies Through Liquidity Zone We have seen higher prices in most equity markets since the CPI release came in lower than expected on November 10th. Read More…

Professional Trader Withdraws Over $6K, Explains Why OneUp Trader Is The Best Prop Firm

Who Is He & Why He Chose OneUp Trader Franco is a professional trader from Florida and has withdrawn $6,200 in less than 20 days of trading his funded trading account. Franco first learned about trading at a friend’s house and got hooked since then. Trading started as a hobby, but he quickly realized he Read More…

Crude Oil (CL) Futures Forms a Dragonfly Doji On Parabolic Curve

A powerful Dragonfly Doji was formed during yesterday’s volatile session. CL prices bounce off of the Parabolic curve mentioned last Friday. What to expect next? The Parabolic Curve Acts as a Support In yesterday’s volatile session, CL dropped over 6% right into the support zone and the parabolic curve we mentioned in Friday’s technical analysis. Read More…

Technical Outlook: Dow Jones (YM) Futures Prices Continue to Rally

A closer look into the Parabolic channels. Consolidation on the hourly chart could break in either direction. Parabolic Channels With parabolic channels, we take the same approach when drawing the main parabola; we need at least 3 points to make the connection. I’ve marked the main parabola in the image below with the connection points. Read More…

Technical Analysis: Crude Oil (CL) Futures Prices Consolidating

A Parabolic channel has been identified on the Daily Chart. CL is trading off a support zone at $81.40. Important note on stop placement. Chart Analysis Recap The Head & Shoulders pattern referenced in our CL chart analysis on November 7 did not confirm. The neckline acted as a barricade that the bulls could not Read More…

Price Action Setups: E-mini Nasdaq 100 (NQ) Futures

The Daily chart shows signs of a rollover. Gaussian channel, candlestick, and Fibonacci analysis on the Daily chart. There is a potential Marg Simpson pattern on the 4-Hourly chart. Medium Term Outlook The Equity markets have enjoyed a rebound spurred on by the fall in the price of the Dollar. The three main aspects to Read More…

Technical Analysis: Euro Fx (6E) Surges Through Downward Channel

6E has surged through the long-term down channel. The most apparent price zones to watch in the medium term. Fibonacci Fan Analysis on 1-Hourly chart. Euro Surges Out Of Downward Channel Due To a Weakening Dollar We have been tracking the Euro’s downward channel for some time now, and for a while, it seemed the Read More…

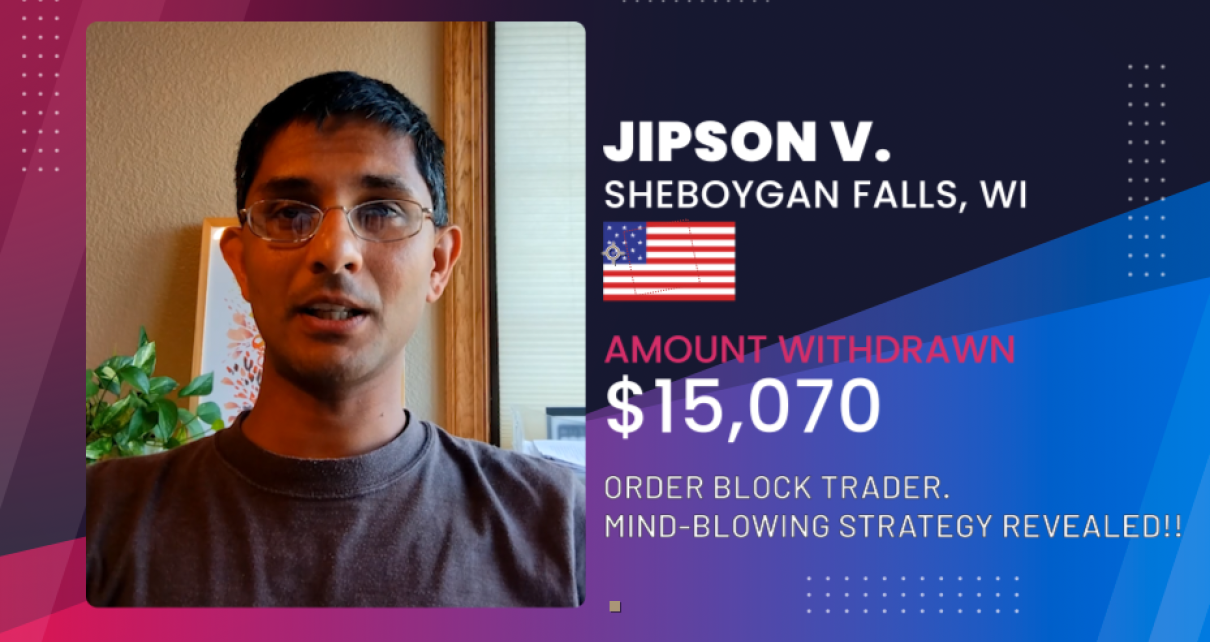

Order Block Trader Withdraws $15,000 – Unique Strategy Revealed!

Who Is He & Why He Chose OneUp Trader Jipson is a veteran trader from Wisconsin who completed the $50,000 Evaluation this year. He believes OneUp Trader offers the best deals in the industry, with a one-step evaluation, a flexible daily loss limit, and less restrictive maximum drawdown parameters. Jipson loves the 24/7 customer support Read More…

Technical Analysis: Gold Soars 10% In One Week

Gold prices trading the major support zone on the monthly chart Potential bullish targets. RSI showing overbought in the short run. Bull flags and the Gaussian channel on the hourly chart. Monthly View We did a piece a few months ago on the multi-year support zone in Gold between $1,674.1 and $1715.5 here. The Gold Read More…

Crude Oil (CL) Futures Analysis – Head & Shoulders Neckline Tested

The Neckline of the Inverse Head & Shoulders pattern Daily chart is tested. Fibonacci targets revisited from last week. Price zones to keep in mind while trading today’s session. Quick Recap In our analysis from last week, the Head & Shoulders and Parabola were the main focus. CL price has broken the Parabola, which signals Read More…