Crude oil futures traded higher on Tuesday morning as ongoing geopolitical tensions in West Asia continued to impact the market. Brent oil futures were up 0.29% to $90.64, while May West Texas Intermediate crude futures gained 0.21% to $86.61. Tensions in the Middle East drove the surge in crude prices. The much-anticipated peace talks between Read More…

S&P 500 (ES) Futures, Bulls In Control

S&P 500 Futures Rise Amid Fed Rate Cut Speculation Investor concerns over prolonged higher interest rates weighed on the S&P 500 last week. Federal Reserve Chair Jerome Powell emphasized the need for concrete evidence of inflation nearing the 2% target before considering rate adjustments. This cautious stance has led to a downward revision in market Read More…

New Funded Trader Finds Success with OneUp Trader

Corey Payne from Dallas, Texas is one of the latest ‘scalp style’ traders to receive funding through OneUp Trader. Payne received his $25,000 funded trading account in January 2024 after passing the evaluation in just 17 days. “I chose the $25,000 account size because it offers the best ratio between the profit target and trailing Read More…

Gold Futures (GC) Bulls Over Extended

Weekly Chart Breakout Confirmation The breach of the previous ATH a few weeks ago remains as the most significant event on the Gold chart this year. With that level now acting as resistance near $2089, we could wait for a pullback to take a long position because at current levels, we would be chasing the Read More…

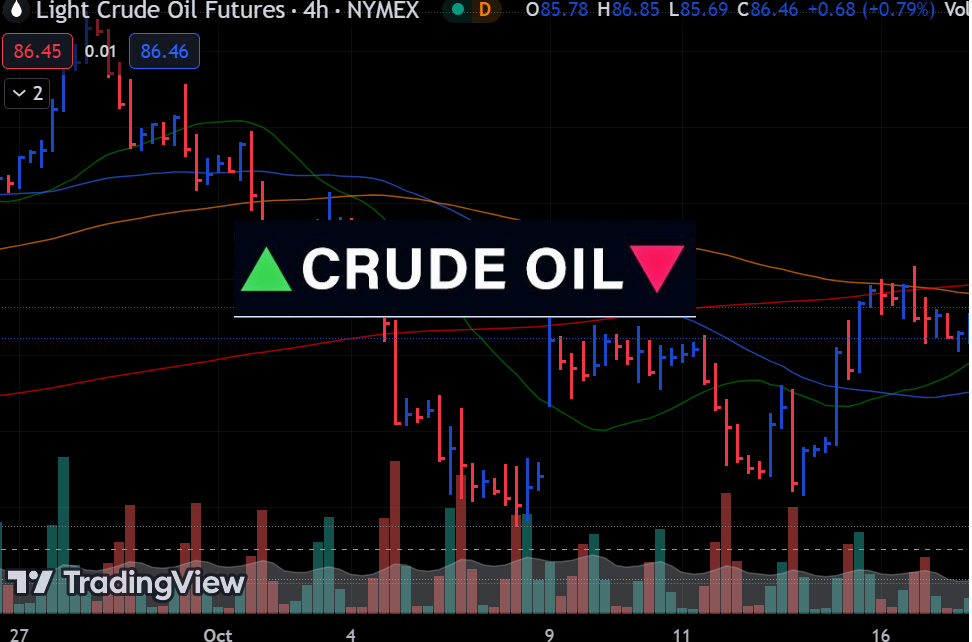

Crude Oil Futures: Technical Outlook

Trade Opportunities and Levels to Watch: Support Levels: Resistance Levels: MACD Indicator: Volume: Trade Strategy: Stay vigilant for any signs of trend weakness or reversal, and remember that trading requires flexibility. If the market structure changes, be prepared to reassess your strategy and manage your positions accordingly. Always ensure your trades align with your risk Read More…

Triangle Chart Pattern Trading Strategy

Introduction The triangle chart pattern is a popular technical analysis formation used by traders to identify potential trading opportunities. This pattern is formed by converging trendlines, creating a triangular shape on the price chart. There are different types of triangle patterns, including: This guide will provide an overview of the different triangle chart pattern trading Read More…

NASDAQ Futures (NQ) Trade Opportunities

Weekly Chart Analysis: Key Levels to Monitor: Daily Chart Analysis: Trade Strategy: Before entering any trade, confirm it aligns with your risk tolerance and trading plan. Monitor the trade actively, adjusting stop-losses and targets as the market moves. Stay informed and be ready to act on new information that could influence market direction.

Crude Oil Futures (CL) show continued resilience

Light Crude Oil Futures have been showcasing resilience, marking an upward trajectory after a consolidation phase at a key support level. The weekly chart reveals a rally above the 40-week moving average. The price is trading within the Bollinger Bands, edging closer to the upper band. The RSI on both daily and weekly charts is Read More…

T-Bond Technical Analysis, Buying Still High

Monthly Chart Analysis:The long-term monthly trend has revealed a downward pressure since its peak around 2020. However, recent candles suggest a potential stabilization. The Momentum indicator has dropped into negative territory, which tells us there is a slowdown in the selling pressure. Daily Chart Analysis:Price action has settled around key moving averages as the battle Read More…

NASDAQ Futures (NQ) Hit New ATH: Technical Analysis

Like most markets around the world at the moment, US equities are on a tear, especially after the rate data yesterday. It is really difficult to find a bearish opportunity in this market, which points us in the direction of ‘the trend is your friend’. Daily Chart:The market is trading within a rising channel, showing Read More…