Introduction Since the prior analysis conducted in mid-September, the bearish double-top formation has played out as predicted. Price Movement Since September 11 RSI (Relative Strength Index) Short-Term Outlook: Medium-Term Outlook: Final Call:

Gold futures (GC) bull flag on weekly chart

Bullish Structure Still Intact The price of Gold Futures (GC) has continued its strong uptrend, respecting the bullish structure from our previous analysis. The bull flag is still intact, and gold prices are on their way to hitting the bullish target of 2,842. From here we can assume that if the target is hit, it Read More…

Updated Technical Analysis for E-mini Russell 2000 Futures (RTY)

Summary of Previous Analysis The original short trade idea was based on a failed breakout attempt above the $2,275 resistance, leading to a short entry around $2,233, with a stop loss at $2,320.5 and a target near the trendline at $2,135. The rationale for the trade was the concentration of volume in the $2,150-$2,275 range Read More…

Bull Target Hit On Crude Oil Futures!

Introduction In our earlier analysis, I mentioned key levels in CL crude futures, focusing on a support zone between $66-$71 and a potential breakout above $78.04. There was an expectation of a rally towards higher targets if the price successfully broke above the descending trendline and the 100-week EMA. With escalating geopolitical tensions involving Iran Read More…

U.S. Dollar Surges on Fed Policy, Technical Outlook

Introduction The Dollar has been surging for the past few sessions, posting five straight green candles. Without looking at any fundamentals in today’s overview, lets dive straight into the technicals and see what we can find. Technical Analysis The Dollar is overextended in the short term with the RSI in overbought territory. Price has also Read More…

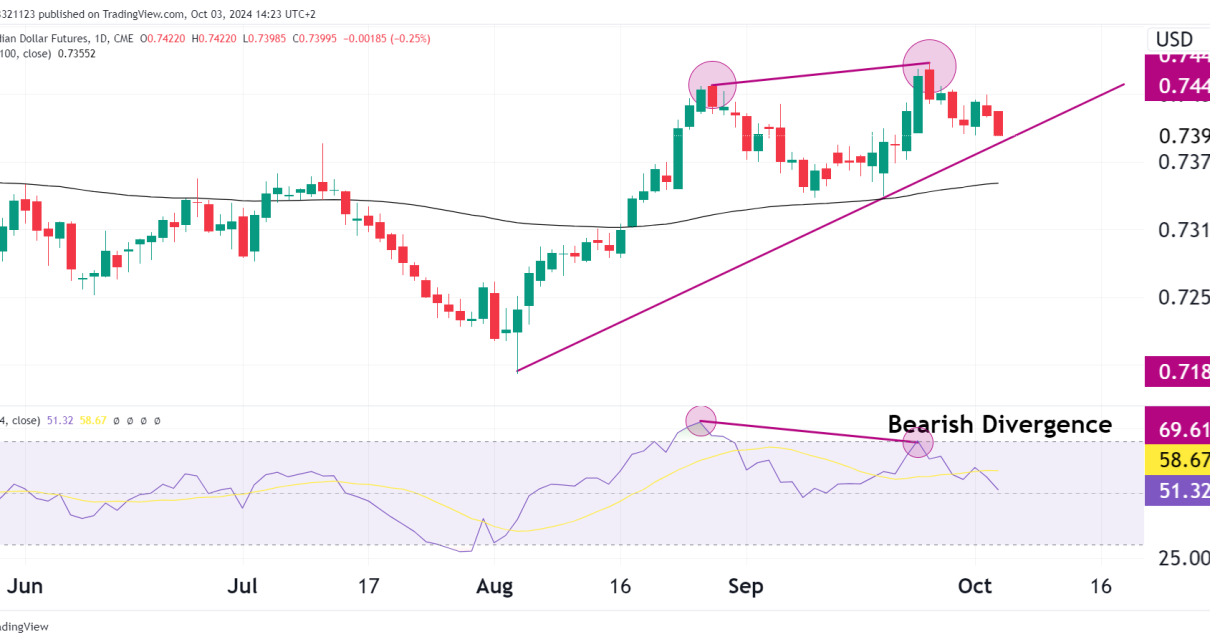

Bearish Divergence on Canadian Dollar (6C)

Introduction We haven’t looked at 6C for a while, but there is an interesting pattern we can look at and learn from. Let’s break down the analysis and find high-probability trade setups while explaining the bearish divergence pattern highlighted in the image. Before we go further, you can learn all about bearish divergence in the Read More…

Karan Is Back With a $28,000 withdrawal One Year Later!

Last year, we introduced you to Karan, a funded trader who withdrew $17,500 from his funded trading account. This year, he is back with another big withdrawal while still trading his aggressive scalping style. Since our last article, OneUp Trader announced that traders could now get funded on up to three accounts at a time, Read More…

Crude Oil prices up 6% on Middle East tensions, technicals point to $78 target

Fundamentals WTI crude futures rose 1.56% to $70.92 per barrel late Tuesday as fears of oil supply disruptions grew after Iran launched ballistic missiles at Israel. Iran fired over 180 missiles in retaliation for Israel’s campaign against Hezbollah in Lebanon, escalating tensions in the oil-rich region. ANZ Research noted Iran’s involvement raises concerns about potential Read More…

Bitcoin Hits Resistance, Bearish 54K in Sight?

Introduction Bitcoin is up 43% YTD and 131% for the past year. The surge has come after a horrific bear market that saw ‘digital gold’ crash by 80%. The rally we have seen has now stalled, and the chart is no longer printing aggressive higher highs like we saw earlier in the year. However, it Read More…

Short Trade on Russell 2000 (RTY) Futures, $2,135 in sight

Introduction As we approach the final quarter of 2024, the E-mini Russell 2000 Index Futures presents a short trade opportunity that has caught our attention. After a 23% rally for the past year and multiple tests of the resistance level shown on the chart below, it could be time for a pullback. Let’s see what Read More…