Introduction Nasdaq-100 futures (NQ) are stabilizing after bouncing from a multi-week low near 24,300 earlier in November. The index has now reclaimed the 25,000 level and is trading just beneath a major resistance band that has capped every rally since late October. From here, bears could try to push the price back to the level Read More…

Gold Futures (GC) Technical Analysis | 26 November 2025

Introduction Gold futures (GC) are gaining bullish momentum again, climbing and pushing back above $4,190 and making space between itself and the 50-day moving average. Now the all-time high of $4,398 is back in sight, and GC only needs to rally 4.6% to hit it. Let’s take a closer look at the technicals and what Read More…

Russell 2000 (RTY) Technical Analysis 25 November 2025

Introduction The Russell 2000 Futures (RTY) have attempted a bullish shift and are targeting the 50-day moving average. A reclaim of that moving average is necessary for bulls to gain the upper hand again. Small-cap stocks remain weaker than large-cap indices, but the recent bounce in the RSI and price could signal that the retracement Read More…

Nasdaq 100 (NQ), Technical Analysis 24 November 2025

Introduction The Nasdaq 100 Futures (NQ) are attempting to consolidate after a sharp drop that pushed the price back into the support zone in last week’s analysis. On November 17, NQ dipped below the support band at 24,400 and the 50-day moving average. Since then, the index has continued to weaken. Let’s take a closer Read More…

Dow Jones Futures (YM) Technical Analysis 20 November 2025

Introduction E-mini Dow Jones Futures (YM) have dipped 5.2% from the recent all-time high of $48,542. The selloff has meant the price has dipped below the 50-day moving average, which bulls will be looking to reclaim. The 200-day moving average is far below the current price; it would be a further drop of 5% for Read More…

Crude Oil Futures (CL) Technical Analysis, 19 November 2025

Introduction Crude oil futures (CL) have continued to consolidate since our previous analysis. Despite last week’s rebound from $56–$57 support, buyers have not been able to force a breakout above the 50-day moving average. Bears will be aiming for the lower support zone at $56, while bulls will be trying to push the price above Read More…

Nasdaq 100 Futures (NQ), Technical Analysis 17 November 2025

Introduction The Nasdaq 100 Futures (NQ) have rebounded on Monday, showing the first sign of stabilization after the sell-off began in late October. Price action now sits right on top of the same support zone highlighted in the November 4th analysis, where the previous all-time high, 50-day moving average, and pivot structure converge. While momentum has Read More…

Geoffrey Withdraws $14,000 in 6 Days Pushing His Total to $33,500

Introduction Last time we featured Geoffrey, a registered nurse who traded futures on the side and withdrew $13,000 in just six trading days. Since then, he’s continued his winning streak — his latest withdrawal added $14,000 in only six days, bringing his total withdrawals to $30,500. What makes this even more impressive? Geoffrey balances his demanding Read More…

Nasdaq 100 (NQ) Technical Analysis 13 November 2025

Introduction The Nasdaq 100 Futures (NQ) are continuing the slow, controlled pullback that began after the index surged to fresh all-time highs in late October. Price action remains consistent with the consolidation described in the previous analysis. Despite recent softness, the uptrend remains intact, with NQ still trading comfortably above its major moving averages. The Read More…

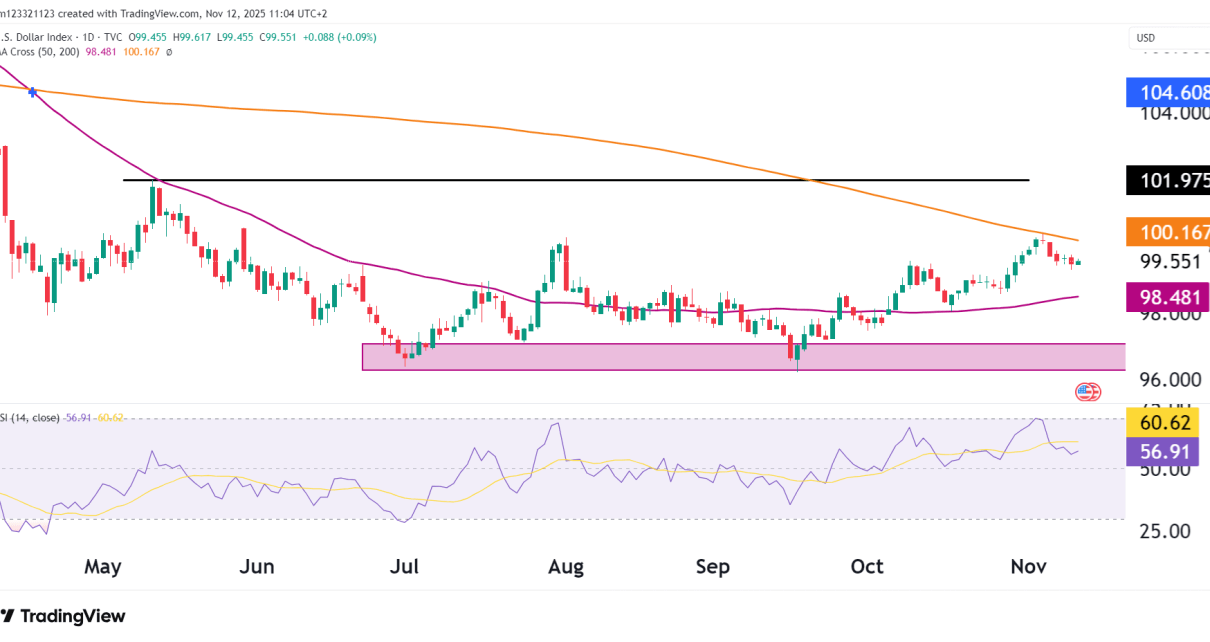

U.S. Dollar Index (DXY) Technical Analysis 12 November 2025

Introduction The U.S. Dollar Index (DXY) continued to rally since our previous analysis and tested the 200-day moving average before touching it and retracing slightly. The greenback’s recovery from October lows and support zone has been hopeful for the bulls; now, they will be looking to clear above the 200-day MA to continue with the upward momentum. Read More…